Chairman Dave Camp (R-MI) of the Ways and Means CommitteeThe Committee on Ways and Means, more commonly referred to as the House Ways and Means Committee, is one of 29 U.S. House of Representative committees and is the chief tax-writing committee in the U.S. The House Ways and Means Committee has jurisdiction over all bills relating to taxes and other revenue generation, as well as spending programs like Social Security, Medicare, and unemployment insurance, among others. detailed some significant changes specific to the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. treatment of S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). s in the tax reform plan he recently released.

The biggest changes would reform payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. treatment for owners of S corporations, the treatment of active and passive income, and the differentiation between manufacturing and non-manufacturing income (e.g. service or retail businesses).

The focus of Rep. Camp’s plan was to create a simpler tax code with lower rates in exchange for a broader tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. es – sole proprietorships, partnerships, and s corporations – pay taxes on individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. forms, so the changes to the individual code impact these types of businesses.

Camp’s plan would consolidate 7 brackets down to effectively 3 brackets of 10, 25, and 35 percent (which includes a 10 percent surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. for non-manufacturing high earners and is calculated under a new definition of income). He would repeal the alternative minimum tax and increase the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. while modifying or eliminating many current tax provisions. Specifically for small businesses, the plan would set the level for section 179 business expensing at $250,000 (down from $500,000 in 2013).

These are positive changes, but overall the tax reform plan does little improve the tax code for small businesses, specifically S corporations. The proposal leaves in place high tax rates for many S corporations, subjects them to additional payroll taxes, creates new distortions between types of industries, and produces two tax rate bubbles.

Included below are the major changes to the taxation of S corporations under Camp’s plan, including a state by state comparison of top marginal tax rates under Camp’s plan versus current law. You can find all the basics of his plan here.

Creates Different Tax Treatment for Manufacturing and Non-Manufacturing Industries

Camp’s tax reform package introduces complication with a new 10 percent surtax for non-manufacturing income. To make things more complicated, the additional 10 percent surtax would be calculated on a different income scale: modified adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” or MAGI. This essentially creates two side by side tax codes, a la the AMT, and individuals and businesses would have to calculate their AGI for one and their MAGI for the other.

MAGI aside, this tax provision would favor manufacturing over non-manufacturing industries, such as retail or service industries. This non-neutral tax treatment distorts the economy and should be avoided when designing a new tax system.

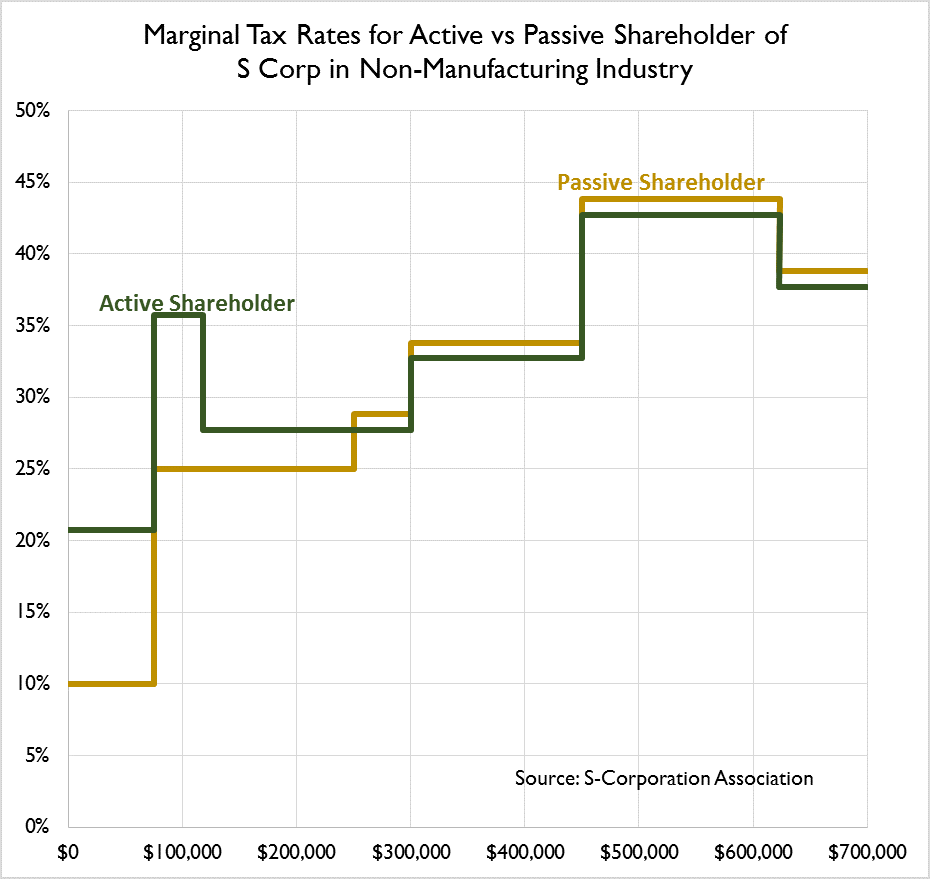

In the chart below, you can see the difference in marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s for an S corporation in a manufacturing industry compared to an S corporation in a retail or service related industry. All industries face the same marginal tax rate until the 10 percent surtax begins at $450,000 MAGI for a joint filer ($400,000 for single).

The surtax means S corporations in a non-manufacturing industries with income $450,000 and above would face higher marginal tax rates than manufacturing businesses. While it appears that manufacturing businesses avoid this rate all together, due to new 70/30 split self-employment rule (which we discuss more below) active shareholders will still be hit by 70 percent of surtax, or a 7 percent surtax. For active shareholders, manufacturing businesses face a top rate of 34.7 percent and non-manufacturing faces a rate of 37.7 percent. For passive shareholders, the difference between business types is the full 10 percentage points of the surtax.

This surtax impacts a large amount of business income due to the fact that nearly 70 percent of employer business income is earned by business owners with income over $500,000.

The Difference between Active and Passive Shareholders

The difference between active and passive shareholders is important for determining the marginal tax rates for S corporations under Chairman Camp’s plan.

Active shareholders are those actively involved in the running of a business. They act as both an owner of the business and an employee. This means they receive wages and a share of distributed profits. Currently, active shareholders must take a reasonable salary as defined by the IRS. This is to prevent owners of S corporations from avoiding the payroll tax.

Passive shareholders serve solely as stockholders or owners of the S corporation. They do not take an active role in the day to day operations of the company and do not receive wages. Like active shareholders, passive shareholders pay taxes on their individual income tax return at individual tax rates. Additionally, passive shareholders with incomes over $250,000 are subject to the 3.8 percent surtax in the Affordable Care Act.

Changes to Self-Employment Taxes: the 70/30 Split Rule for SECA Taxes

Under current law, the IRS requires business owners to pay themselves a reasonable wage in order to prevent people from gaming this income distinction in order to avoid the extra 15.3 percent payroll tax hit.

Camp’s plan would replace the current reasonable wage standard with a 70/30 split, changing the rules for active shareholders. The rule would require that active shareholders of S corporations report 70 percent of their total earning as wage income.

Every dollar a business owner receives in S corporation income will be summed together. This income will be then split into two parts. 70 percent of the income will be considered wage income and be taxed with the additional payroll tax. The remaining 30 percent will be considered business income and be exempt from the payroll tax.

For S-Corporations that make a significant amount of money, and paying a reasonable wage as in the above example, this rule will mean a tax increase. In contrast, if the S-Corporation is currently paying all of its profits are wages, this will actually mean a tax cut.

In total, this change would act as a tax increase of $15.3 billion over ten years for S corporations.

Tax Rate Bubble

Another element of Camp’s tax plan is the creation marginal tax rate bubbles. This occurs when a marginal tax rate, for example, goes from 10 percent to 15 percent and back down to 10 percent. We have a post that discusses the marginal tax rates under Camp’s plan, which you can find here.

Specifically for S corporations, Camp’s plan would create two bubbles for active shareholders and one bubble for passive shareholders for both manufacturing and non-manufacturing businesses. The chart below shows these bubbles using the rates for non-manufacturing businesses.

The reason for the first bubble is the new 70/30 split rule for payroll, or SECA, taxes. Active shareholders of S corporations would be required to pay a payroll tax of 15.3 percent on 70 percent of their income below the FICA cap of $117,900, or put differently, a 10.7 percent tax on all income up to the cap. Above the FICA cap, active shareholders are required to the Medicare tax of 3.8 percent on 70 percent of income, or 2.7 percent tax on all income above the cap.

When we add the SECA taxes to the individual tax rates, we get a bubble when the rate goes from 20.7 percent to 39.7 percent, and then down to 34.7 percent. The marginal tax rates in Camp’s plan are shown in the table below:

|

Marginal Tax Rates for S-Corporations Under Camp's Tax Reform Proposal |

||||

|

Source: S-Corporation Association, Tax Reform Act of 2014 |

||||

|

Manufacturing S Corp |

Retail/Service S Corp |

|||

|

Passive Shareholder |

Active Shareholder |

Passive Shareholder |

Active Shareholder |

|

|

Less than $75,000 |

10.0% |

20.7% |

10.0% |

20.7% |

|

$75,000 to $117,900 |

25.0% |

35.7% |

25.0% |

35.7% |

|

$117,900 to $250,000 |

25.0% |

27.7% |

25.0% |

27.7% |

|

$250,000 to $300,000 |

28.8% |

27.7% |

28.8% |

27.7% |

|

$300,000 to $450,000 |

33.8% |

32.7% |

33.8% |

32.7% |

|

$450,000 to $513,600 |

33.8% |

39.7% |

43.8% |

42.7% |

|

$513,600 to $623,600 |

33.8% |

39.7% |

43.8% |

42.7% |

|

$623,600 and Above |

28.8% |

34.7% |

38.8% |

37.7% |

The second bubble, which both passive and active shareholders face, is due to the phase out of the 10 percent tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and the phase out of the standard deduction. These phase outs begin at $300,000 for joint filers ($250,000 for individuals) of MAGI.

Plan doesn’t Significantly Lower Tax Rates

Compared to current law, Camp’s plan does not significantly lower the top marginal tax rate for S Corporations. These are the major law changes the affect the marginal tax rate under Camp’s reform plan:

- Reduction of the top marginal tax rate from 39.6 percent to 25 percent plus a 10 percent surtax applied to non-manufacturing income.

- Elimination of the Pease limitation on itemized deductions and the state and local income tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions.

- The introduction of the 70/30 split rule, subjecting S Corporation profits to self-employment taxes.

The table below compares the combined state and federal top marginal tax rate of S corporations under current law to Camp’s plan by state.

In general, S corporations will see slightly lower top marginal tax rates.

The exception, of course, are S corporations with manufacturing income. They will face lower top marginal tax rates as a result of being partially exempt from the 10 percent surtax.

Non-manufacturing S corporations in ten states with relatively high state and local income taxes are the only ones that will face slightly higher marginal rates. This is mainly due to the repeal of the state and local income tax deduction.

|

Comparison of Top Marginal Tax Rates of S Corps (Active Shareholders), Current Law vs. Camp Plan, by State |

|||

|

Current Law |

Camp Plan (Retail) |

Camp Plan (Manufacturing) |

|

|

Alabama |

42.8% |

41.2% |

38.4% |

|

Alaska |

39.6% |

37.7% |

34.7% |

|

Arizona |

43.5% |

42.2% |

39.2% |

|

Arkansas |

45.0% |

44.7% |

41.7% |

|

California |

48.9% |

51.1% |

48.1% |

|

Colorado |

43.6% |

42.3% |

39.3% |

|

Connecticut |

44.8% |

44.4% |

41.4% |

|

Delaware |

45.6% |

45.6% |

42.6% |

|

Florida |

39.6% |

37.7% |

34.7% |

|

Georgia |

44.4% |

43.7% |

40.7% |

|

Hawaii |

47.4% |

48.7% |

45.7% |

|

Idaho |

45.2% |

45.1% |

42.1% |

|

Illinois |

43.8% |

42.7% |

39.7% |

|

Indiana |

43.7% |

42.6% |

39.6% |

|

Iowa |

44.2% |

43.7% |

41.0% |

|

Kansas |

44.0% |

43.0% |

40.0% |

|

Kentucky |

44.4% |

45.7% |

42.7% |

|

Louisiana |

43.0% |

41.6% |

38.7% |

|

Maine |

45.6% |

45.6% |

42.6% |

|

Maryland |

46.0% |

46.3% |

43.3% |

|

Massachusetts |

43.9% |

42.9% |

39.9% |

|

Michigan |

44.4% |

43.7% |

40.7% |

|

Minnesota |

46.7% |

47.5% |

44.5% |

|

Mississippi |

43.8% |

42.7% |

39.7% |

|

Missouri |

44.7% |

44.2% |

41.2% |

|

Montana |

44.9% |

44.6% |

41.6% |

|

Nebraska |

44.9% |

44.5% |

41.5% |

|

Nevada |

39.6% |

37.7% |

34.7% |

|

New Hampshire |

39.6% |

37.7% |

34.7% |

|

New Jersey |

46.2% |

46.6% |

43.6% |

|

New Mexico |

43.7% |

42.6% |

39.6% |

|

New York |

47.4% |

48.6% |

45.6% |

|

North Carolina |

44.3% |

43.5% |

40.5% |

|

North Dakota |

42.7% |

40.9% |

37.9% |

|

Ohio |

45.4% |

45.3% |

42.3% |

|

Oklahoma |

44.0% |

42.9% |

39.9% |

|

Oregon |

47.0% |

47.9% |

44.9% |

|

Pennsylvania |

42.6% |

42.7% |

39.7% |

|

Rhode Island |

44.4% |

43.7% |

40.7% |

|

South Carolina |

43.8% |

44.7% |

41.7% |

|

South Dakota |

39.6% |

37.7% |

34.7% |

|

Tennessee |

39.6% |

37.7% |

34.7% |

|

Texas |

39.6% |

37.7% |

34.7% |

|

Utah |

43.8% |

42.7% |

39.7% |

|

Vermont |

46.2% |

46.6% |

43.6% |

|

Virginia |

44.3% |

43.4% |

40.4% |

|

Washington |

39.6% |

37.7% |

34.7% |

|

West Virginia |

44.7% |

44.2% |

41.2% |

|

Wisconsin |

45.4% |

45.3% |

42.3% |

|

Wyoming |

39.6% |

37.7% |

34.7% |

|

DC |

46.2% |

46.6% |

43.6% |

|

U.S. Average |

43.9% |

43.3% |

40.3% |

Update: The marginal tax rates for active shareholders in the manufacturing sector were updated to reflect the correct treatment under the 70/30 split rule.

Share