Tax Policy Proposals for the German EU Presidency

5 min readBy:Today begins Germany’s presidency of the council of the European Union. The EU presidency rotates among EU member countries every six months; Germany’s presidency will last through the end of 2020. In addition to a new six-month presidency, this is also the beginning of an 18-month cycle with Germany, Poland, and Slovenia working on a common agenda.

Much of Germany’s agenda for the next six months is focused on policies to ensure economic stability and recovery from the COVID-19 pandemic. However, there is a pair of tax policies unrelated to the pandemic that Germany is planning to develop and move forward at the EU level: a financial transaction taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. and a minimum effective tax. Both policies would harm capital formation in the EU, which would be a drag on economic growth.

Financial Transaction Tax

FTTs are levied on the trade in financial instruments such as stocks, bonds, or derivatives. Under an FTT, a percentage of the asset’s value is paid in taxes when it is traded. For example, if an investor sells an asset worth $1,000, they would be charged $1 on the transaction under a 0.1 percent FTT. FTTs usually apply only to select financial instruments and often have varying tax rates depending on the asset type.

A FTT was first proposed for the EU in 2011, with a tax rate of 0.1 percent for exchanges of shares and bonds and a 0.01 percent rate for derivatives. At the time, it was estimated the tax would raise €57 billion (US $64 billion) annually. The proposal for the EU-wide policy has languished, however.

Six EU countries have an FTT and 10 member countries (including Germany) have been working on negotiations for a common FTT since 2013.

| Country | Tax Rate |

|---|---|

|

Belgium (BE) |

0.12% – 1.32%* |

|

Finland (FI) |

1.6% – 2.0% |

|

France (FR) |

0.01% – 0.3% |

|

Ireland (IE) |

1% |

|

Italy (IT) |

0.02% – 0.20% |

|

Poland (PL) |

1% |

|

*Belgium’s lower tax rate has been increased from 0.09% to 0.12%; see PwC, “Belgium, Individual – Other taxes,” last updated July 1, 2019, http://taxsummaries.pwc.com/ID/Belgium-Individual-Other-taxes. Sources: BNY Mellon, “A Global View of Financial Transaction Taxes (FTT),” 2018, https://www.bnymellon.com/emea/en/_locale-assets/pdf/our-thinking/tax-and-regulatory-client-forum-2019/global-view-of-financial-transaction-taxes.pdf; and Deloitte, “Tax guides and highlights,” 2020, https://dits.deloitte.com/#TaxGuides. |

|

While FTTs can raise significant revenue, they introduce a variety of distortions into capital markets. These include increased transaction costs, lower trading volumes, and lower asset prices. These forces impact the FTT’s ability to meet revenue targets.

An EU-wide FTT would harm capital formation in the EU and push traders to capital markets with lower transaction costs.

Minimum Effective Tax

Negotiations for a global minimum tax have been ongoing at the Organisation for Economic Co-operation and Development (OECD) since last year. The overall idea is to establish a minimum effective tax rate that would allow countries to tax the difference between the rate paid in one country relative to the minimum.

In the EU context, with Hungary’s corporate tax rate of 9 percent, a French subsidiary in Hungary could be taxed at the 9 percent rate, and then France would be able to tax up to the minimum rate (assuming the minimum rate is higher than 9 percent).

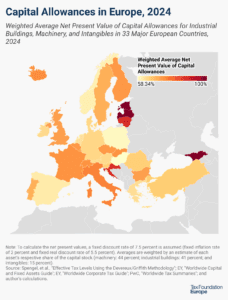

However, there are some significant challenges to designing a minimum effective tax rate. The corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate could be a proxy, but countries in the EU have a variety of policies that impact the effective tax rate for any given business. There are different rules for loss treatment, depreciation of capital assets, and preferences like patent boxes and research and development subsidies that all impact the effective tax rate of a business.

Estonia and Latvia have cash-flow tax systems with a tax rate of 20 percent that applies only to corporate income that is distributed. If income is reinvested in a business, it goes untaxed. For the minimum effective tax, does that mean that the effective tax rate on the reinvested income is 0 percent and an Italian subsidiary in Estonia would get taxed up to the minimum rate? It’s far from clear.

In addition to the design challenges, a minimum effective tax rate would run contrary to tax competition. According to the Tax Foundation’s International Tax Competitiveness Index, Europe is home to both the most and least competitive tax systems in the world. While several EU countries have responded to competitive pressures by adopting policies that are neutral rather than preferential and distortionary, many countries have a variety of tax preferences and high tax rates that can harm investment behavior and economic growth. A minimum effective tax could work against the competitive pressure to adopt neutral, pro-growth policies.

Analysis of the OECD minimum tax proposal shows that it would likely increase the cost of capital and shift the allocation of capital. In the EU context, policymakers should examine how these impacts might change investment and impact employment in the EU. Introducing higher capital costs at a time of economic weakness would be poor policy.

Conclusion

The two key tax issues that Germany is looking to tackle during its EU presidency have the potential to negatively impact capital formation in Europe. Although the political prospects for adoption in the near future are uncertain, the current economic challenges could be prolonged if the policies make it more difficult for Europe to return to growth.

The German policy agenda is rightfully focused on economic stability in the face of this public health crisis; however, the tax items on the agenda appear to run counter to that goal.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe