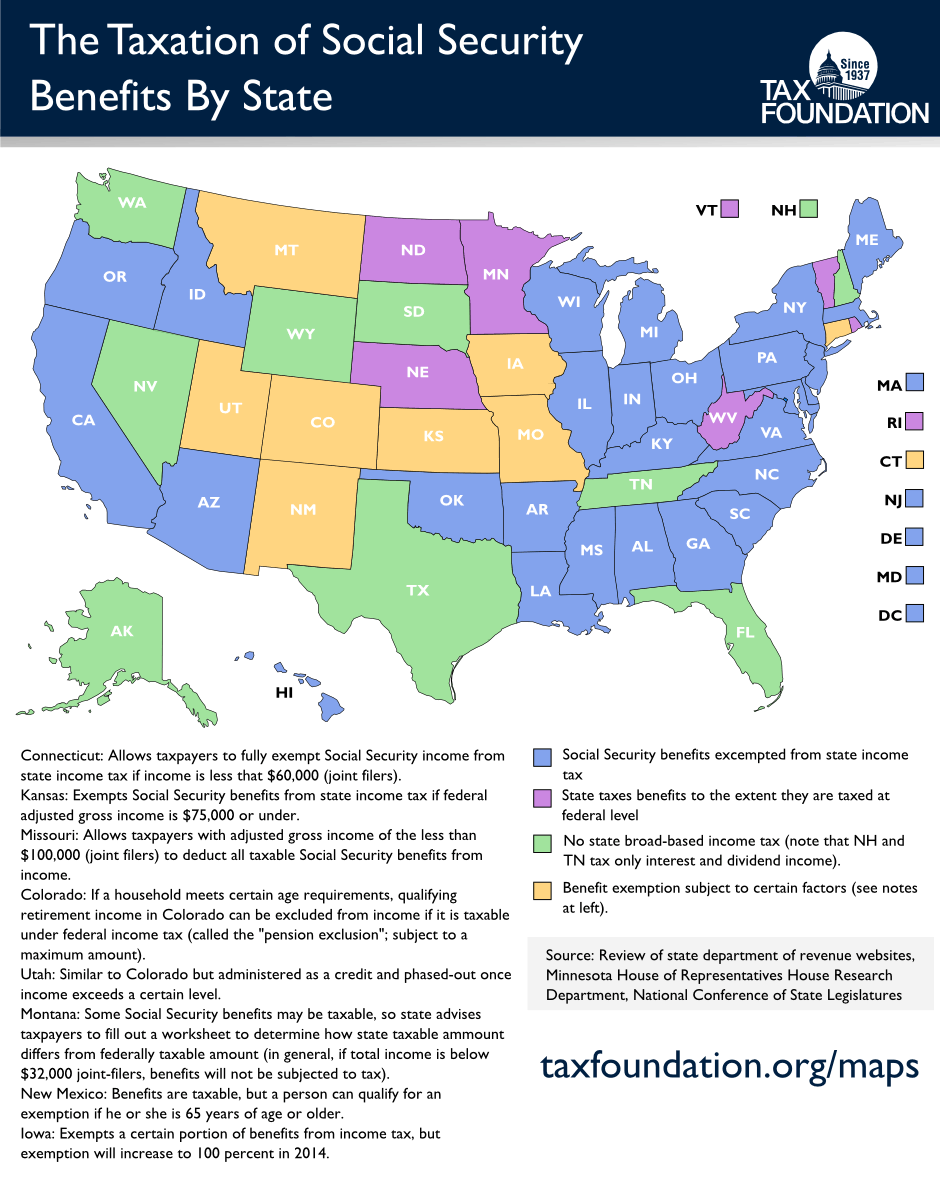

We’re often asked how many states tax Social Security benefits under their state income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . The short answer is that “it depends.” States broadly fall into four categories: (1) states that fully exempt Social Security benefits from their state income tax; (2) states that tax Social Security benefits the same way in which the federal government taxes them; (3) states that base benefit exemptions on certain factors such as age or income; and (4) states that do not tax income at all.

Twenty-seven states, plus D.C., fall in the first category (denoted in blue on the map below) and do not tax Social Security income. Iowa will be added to this list in 2014 after a full-benefit exemption phase-in.

The second category, states that tax benefits in the same way that they are taxed at the federal level, includes six states (denoted by purple on the map). The amount of a person’s Social Security income that is taxable under the U.S. federal tax code depends on two factors: a taxpayer’s filing status and the size of the taxpayer’s “combined income” (adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. + nontaxable interest + half of Social Security benefits). This 30 page document, published by the IRS, is meant to help taxpayers calculate the taxable proportion.

In general, you don’t pay taxes on your Social Security income if that is your only income source. If you have other sources of income and your “combined income” is greater than $32,000 (for joint filers–what the IRS refers to as the “base amount” for your filing status), a portion of your benefits may be taxable (the percentage will vary, but will never be more than 85 percent).

Some states determine benefit exemptions based on other factors, such as income or age, or as a certain percentage of Social Security income (the third category above). These “other” states, denoted in yellow, are outlined below:

- Connecticut allows taxpayers to fully exempt Social Security income from state income tax if income is less than $60,000 (for joint filers).

- Kansas exempts Social Security benefits from state income tax if federal adjusted gross income is if $75,000 or under.

- Missouri allows taxpayers with adjusted gross income of less than $100,000 (for joint filers) to deduct all of taxable Social Security benefits from income.

- If a Colorado household meets certain age requirements, qualifying retirement income can be excluded from income if it is taxable under the federal income tax (it’s called the “pension exclusion” and is subject to a maximum amount).

- A similar program exists in Utah, but it is administered as a credit and is phased-out once income exceeds a certain level.

- In Montana, some Social Security benefits may be taxable, and the state advises taxpayers to fill out a worksheet to determine how the state taxable amount differs from the federally taxable amount. In general, if total income is below $32,000 for joint-filers, benefits will not be subject to tax.

- In New Mexico, benefits are taxable but a person can qualify for an exemption if he or she is 65 years or older (see page 4A of this document to determine exact amount, which is based on income level).

- Iowa exempts a certain portion of benefits from income tax, but this will increase to 100 percent in 2014.

And finally, there are the nine remaining states that do not tax ordinary income and thus also do not tax Social Security income (these states are denoted by lime green on the map).

Check out this week’s Monday Map, found below, to see how your state compares.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe