2016 marks the 30th anniversary of the Tax Reform Act of 1986. Remarkably, in that election year, Congress and the president did what was thought to be impossible—work in a bipartisan manner to defy the armies of interest groups and lobbyists in Washington and enact sweeping taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform.

2016 is also an election year and tax policy is, again, a big issue. But unlike 1986, tax reform is getting mentioned more on the campaign trail than on Capitol Hill. Almost every single candidate in both parties has introduced policies that would alter our tax code. However, the approach that candidates have taken differs tremendously.

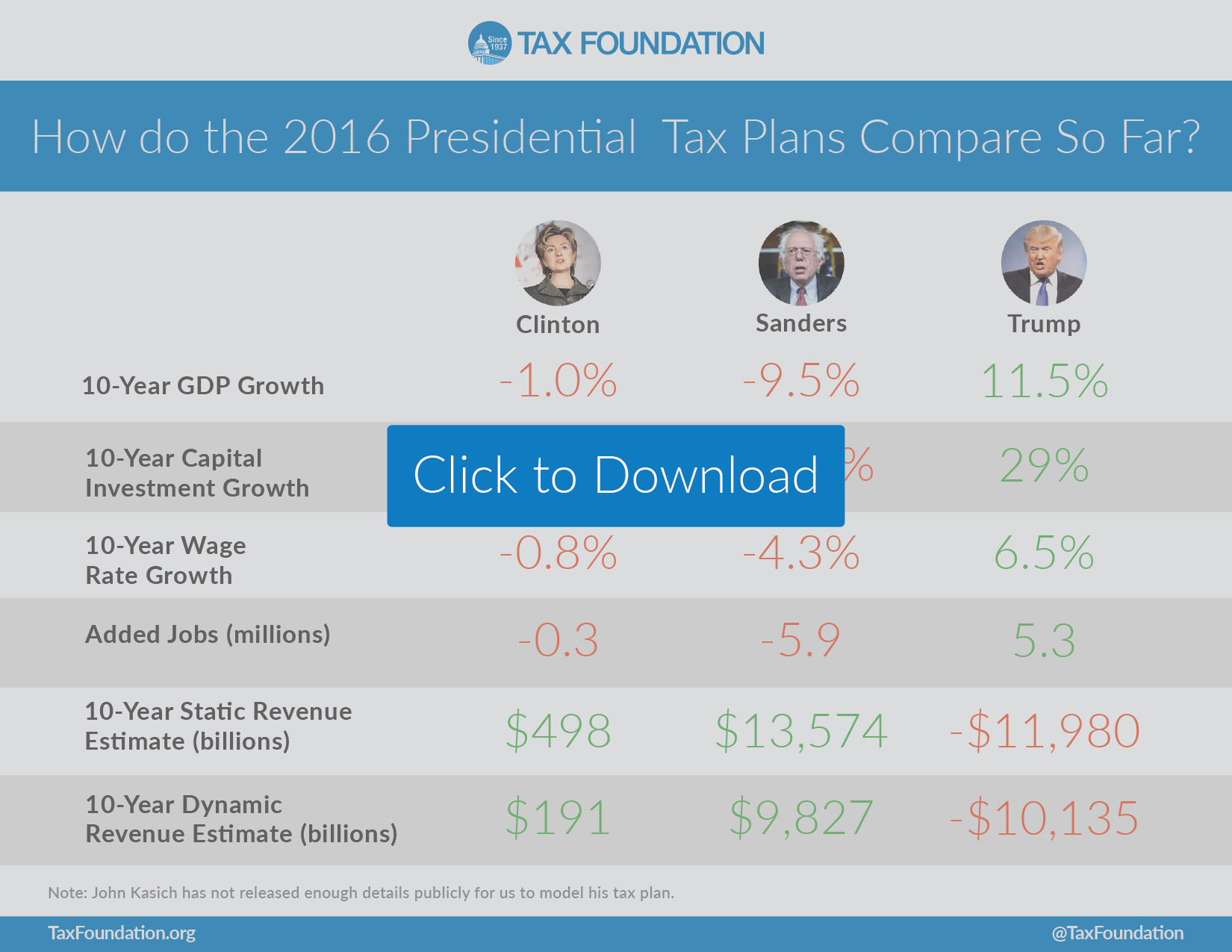

For a side-by-side summary of the details and economic effects of each candidate’s tax plan who is still running, click below:

For a detailed analysis of any of the proposals we scored, select a candidate from the list below:

- Jeb Bush

- Ben Carson

- Lincoln Chafee

- Hillary Clinton

- Ted Cruz

- Bobby Jindal

- Rand Paul

- Marco Rubio

- Bernie Sanders

- Rick Santorum

- Donald Trump

Nearly all Republican candidates argue that the tax code is broken and needs major reforms to boost economic growth, increase investment, and make U.S. companies more competitive. As such, they have introduced significant tax reform plans that would drastically alter the structure of the U.S tax code. Many of these plans would also drastically reduce the amount of revenue the federal government would collect, leading to higher deficits and debt.

Democratic nominees have focused more on using the tax code to both insure economic fairness and collect more revenue to fund government programs they find important. These plans would introduce new taxes on high-income earners and limit the amount of itemized deductions high income taxpayers can benefit from. The new revenue would go toward programs to reduce the price of college education, provide expanded access to healthcare, and infrastructure projects.

But even among the Democratic nominees there is disagreement on tax policy. Hillary Clinton has focused on small, targeted tax increases on high-income taxpayers to fund much smaller expansions to government programs. Bernie Sanders, on the other hand, has proposed more broad-based taxes that impact all taxpayers in order to fund his ambitious domestic policy agenda.

Whether a candidate proposes reforming the entire tax code, or enacting a new tax to pay for a new government program, it is critical that voters understand how candidates’ plans to change the means by which the government raises revenue will impact the broader economy. That is why we have released detailed analyses of the candidates’ tax plans and their economic impacts. Some of the things we measure include:

- The effect on the size of the economy;

- The effect on wages;

- The effect on the number of jobs;

- The effect on federal tax revenues, both in conventional terms, but also after accounting for the effect of the tax changes on the economy; and

- The effect on the after-tax incomes of taxpayers at different income levels, both in conventional terms, but also after accounting for the effect of the tax changes on the economy.

The Tax Foundation’s Taxes and Growth (TAG) Macroeconomic Model simulates the effects of changes in tax policy on these key economic and fiscal factors, providing the public with comparative statistics on each of the presidential tax plans and proposals.

Whenever possible, Tax Foundation economists have communicated with the campaigns to verify how they intended for their tax plans to work. If the campaign did not respond to our inquiry, we made reasonable assumptions which we spell out in detail in our reports.

The TAG model is considered by economists as a “neoclassical” model that measures the effects of tax policy changes on the cost of capital and the supply of labor. In many key respects, it is similar to the Macroeconomic Growth (MEG) model used by Congress’s Joint Committee on Taxation. The TAG model is more of an open economy model than the MEG model and does not attempt to model behavior by the Federal Reserve.

Share this article