Elke Asen was a Policy Analyst with the Tax Foundation’s Center for Global Tax Policy, focusing on international tax issues and tax policy in Europe. Prior to joining the Tax Foundation, Elke interned with the EU Delegation in Washington, D.C., the German Development Agency, and a social startup in Munich, Germany. She holds a BS in Economics from Ludwig Maximilian University of Munich.

Elke was born and raised in a small town of 500 people outside of Salzburg, Austria, and loves to travel. Road tripping and backpacking are her favorites.

Latest Work

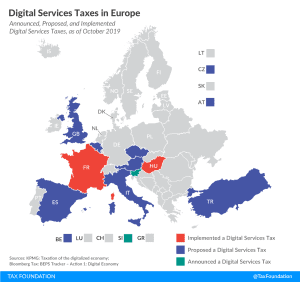

Digital Services Taxes in Europe, 2019

4 min read

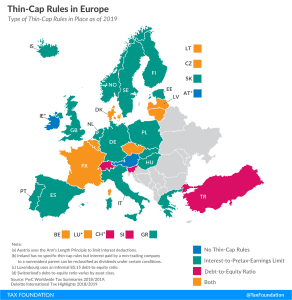

The Economics Behind Thin-Cap Rules

6 min read

Thin-Cap Rules in Europe

2 min read

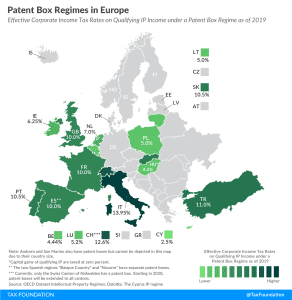

How Patent Boxes Impact Business Decisions

As with every change in tax policy, there are trade-offs. The Modified Nexus Approach adds an additional layer of complexity to the already complex issue of taxing IP income. Linking tax breaks for IP income to its associated R&D activity has changed the game and will likely result in some businesses restructuring and relocating their IP assets and R&D activity. Effective tax rates on IP income will likely play an important role in determining optimal locations, giving measures such as R&D credits more importance. Whether this new approach to IP taxation will impact profit shifting and which countries will be the winners and losers is yet to be seen.

6 min read

Patent Box Regimes in Europe, 2019

4 min read

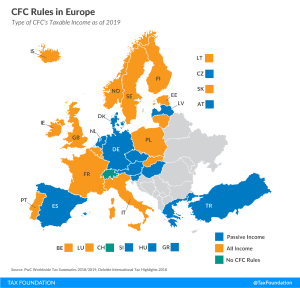

CFC Rules in Europe

2 min read

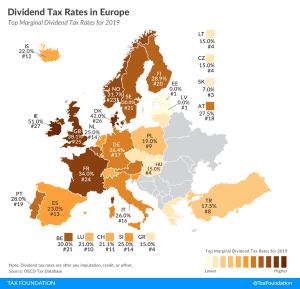

Dividend Tax Rates in Europe, 2019

2 min read

Switzerland Referendum Approves Tax Reform

15 min read

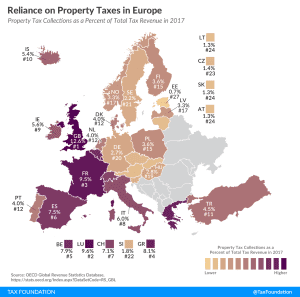

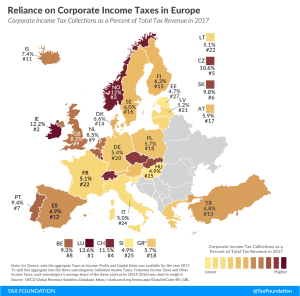

Reliance on Property Taxes in Europe

1 min read

Tax Burden on Labor in Europe, 2019

2 min read

Reliance on Consumption Taxes in Europe

2 min read

New Details on the Austrian Tax Reform Plan

14 min read

Sources of Government Revenue in the OECD, 2019

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read