All Related Articles

The Global Tax Deal, Tax Cuts, and Tariffs—5 Major Tax Debates

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

The High Stakes of Sports Betting Taxes

In this episode, Adam Hoffer, Director of Excise Tax Policy at the Tax Foundation, joins Kyle Hulehan to unpack the intricacies of sports betting tax policy during one of the biggest betting events of the year—Super Bowl 59.

The Inflation Reduction Act One Year Later

One year after its enactment, there are concerns about the Inflation Reduction Acts overall fiscal impact, the additional complexity it introduces to the tax system, and the sustainability of its initiatives.

The Inflation Reduction Act, What to Know

The Inflation Reduction Act would raise taxes on corporations and top earners with the goal of funding a number of programs to reduce carbon emissions, address prescription drug costs, and spur the economy. Garrett Watson joins Jesse Solis to talk through what these tax changes would mean for the economy: Will they reduce inflation, and do they break the President’s pledge not to raise taxes on those earning less than $400,000?

The One About Crypto

How should policymakers view crypto? How big is the issue of tax evasion in the cryptocurrency market and what can realistically be done to curb it? Is it possible to design a rational tax system around what, at times, can appear to be a less-than-rational market and, if so, what should it look like?

The One Big Beautiful Bill, Explained

We break down the House GOP’s One, Big, Beautiful Bill—a sweeping tax package designed to extend key parts of the 2017 Tax Cuts and Jobs Act before they expire in 2026.

The One Big Beautiful Tax Bill: What’s In It, What’s Out

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

The State of State Income Taxes

On this episode of The Deduction, host Jesse Solis and Senior Policy Analyst Katherine Loughead explore how stronger-than-expected revenues and increased workplace flexibility have led to a wave of reforms aimed at enhancing tax competitiveness in states around the country.

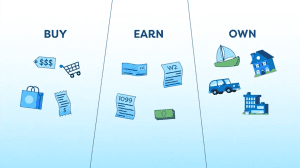

The Three Basic Tax Types

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.

The Three Basic Tax Types

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.