All Related Articles

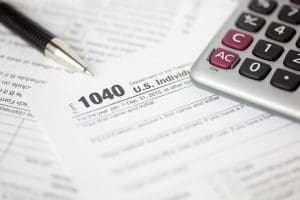

Tax Season’s Greetings

The 2022 tax filing season is about to begin. With expected delays, pandemic-related troubles, and a backlog of over 8 million unprocessed returns from the 2021 tax filing season, Garrett Watson joins Jesse Solis to discuss what all these troubles will mean for taxpayers in what is shaping up to be a chaotic spring.

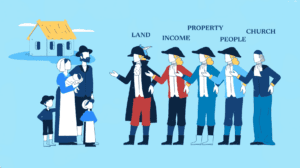

Taxes and the American Revolution

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

Taxes and the French Revolution

The French Revolution provides insight into the relationship between a government and its citizens and serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

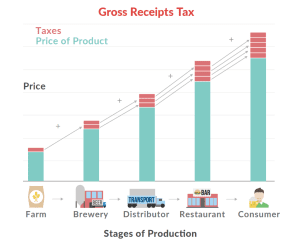

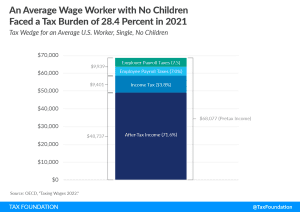

Taxes: The Price We Pay for Government

Have you ever wondered where the money comes from to build roads, maintain a national defense, or pay for programs like Social Security? Taxes.

Taxing Decisions, 2021: Minisode 1

We discuss where the reconciliation package on Capitol Hill stands and talk through recent Tax Foundation modeling, which found that the plan may not have the economic boost its proponents have claimed.