2025 Tax Brackets

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

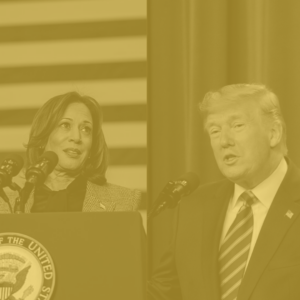

How does tax policy shape a nation’s competitiveness? Today, we’re diving into the showdown between the US and China, exploring how China’s enticing tax incentives pose a formidable challenge to America’s economic supremacy.

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

Trump’s proposal would bring the US more in line with most other developed economies, which tax only those who live and work within their borders.

4 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

Neither presidential candidate has a perfect tax plan. But what changes could Trump and Harris make to their respective tax plans to better serve American workers and the economy? In this episode, we dissect their plans and provide practical solutions for improvement.

Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy.

44 min read

Due to the peculiar design of the proposed tax increase, it’s true: the largest tax increase Oregon has ever seen would create a substantial budget shortfall.

8 min read

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

The 2024 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

7 min read

The Department of Justice (DOJ) recently announced that it would move to reschedule marijuana. This move doesn’t do as much for legal cannabis sales as proposed federal legislation like the States 2.0 Act, but rescheduling cannabis has major ramifications for cannabis businesses.

4 min read

CBO data shows that the federal fiscal system—both taxes and direct federal benefits—is getting more progressive and redistributive in 2024.

7 min read

What do the contrasting tax proposals of Vice President Kamala Harris and former President Donald Trump mean for Americans as the 2024 election approaches?

Social Security is by far the largest federal government spending program. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term.

33 min read

As lawmakers look to renew or revise the 2017 tax cuts that expire next year, they should reconsider the need for a charitable tax deduction in the tax code.

As part of the 2024 presidential campaign, Vice President Kamala Harris is proposing to tax long-term capital gains at a top rate of 33 percent for high earners, taking the top federal rate to highs not seen since the 1970s.

3 min read

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read