State Tax Changes Taking Effect July 1, 2024

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Get ready to hit the autobahn and explore the world of German taxes! We’ll navigate the complexities of Germany’s tax structure.

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

The “Bring Chicago Home” ballot measure would make Chicago’s tax structure substantially less neutral by raising taxes on some property transfers while decreasing taxes on others.

7 min read

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

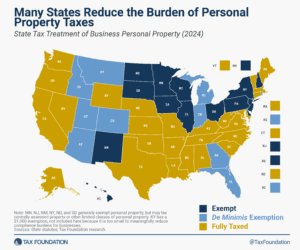

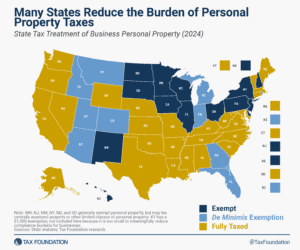

Does your state have a small business exemption for machinery and equipment?

3 min read

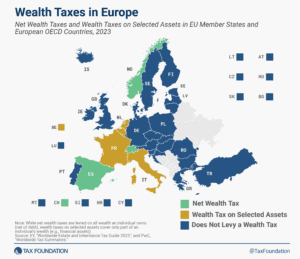

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read