All Related Articles

The ‘Grain Glitch’ Needs to Be Fixed

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

Trends in State Tax Policy, 2018

In 2018, trends to watch in state tax policy will include reductions in corporate tax rates, the spread of gross receipts taxes, new and lower taxes on marijuana, estate tax repeal, a wait-and-see approach on federal tax reform, and more.

16 min read

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

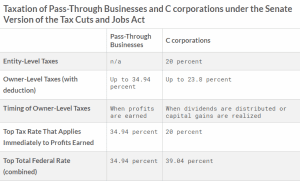

Are Pass-Through Businesses Treated Fairly Under the Senate Version of the Tax Cuts and Jobs Act?

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

Testimony: The Startup Slump: Can Tax Reform Help Revive American Entrepreneurship?

Tax reform should aim to get the tax code out of the way of entrepreneurship by making it simpler, less burdensome, and eliminating its anti-growth biases.

Testimony: The Tax Code as a Barrier to Entrepreneurship

Lawmakers interested in removing barriers to entrepreneurship should consider ways to mitigate 3 distortions in the U.S. tax code: the limited deductibility of business net operating losses, the limited deductibility of capital losses, and lengthy depreciation schedules.

Trends in State Tax Policy

3 min read

2017 State Business Tax Climate Index

16 min read

2015 International Tax Competitiveness Index

13 min read