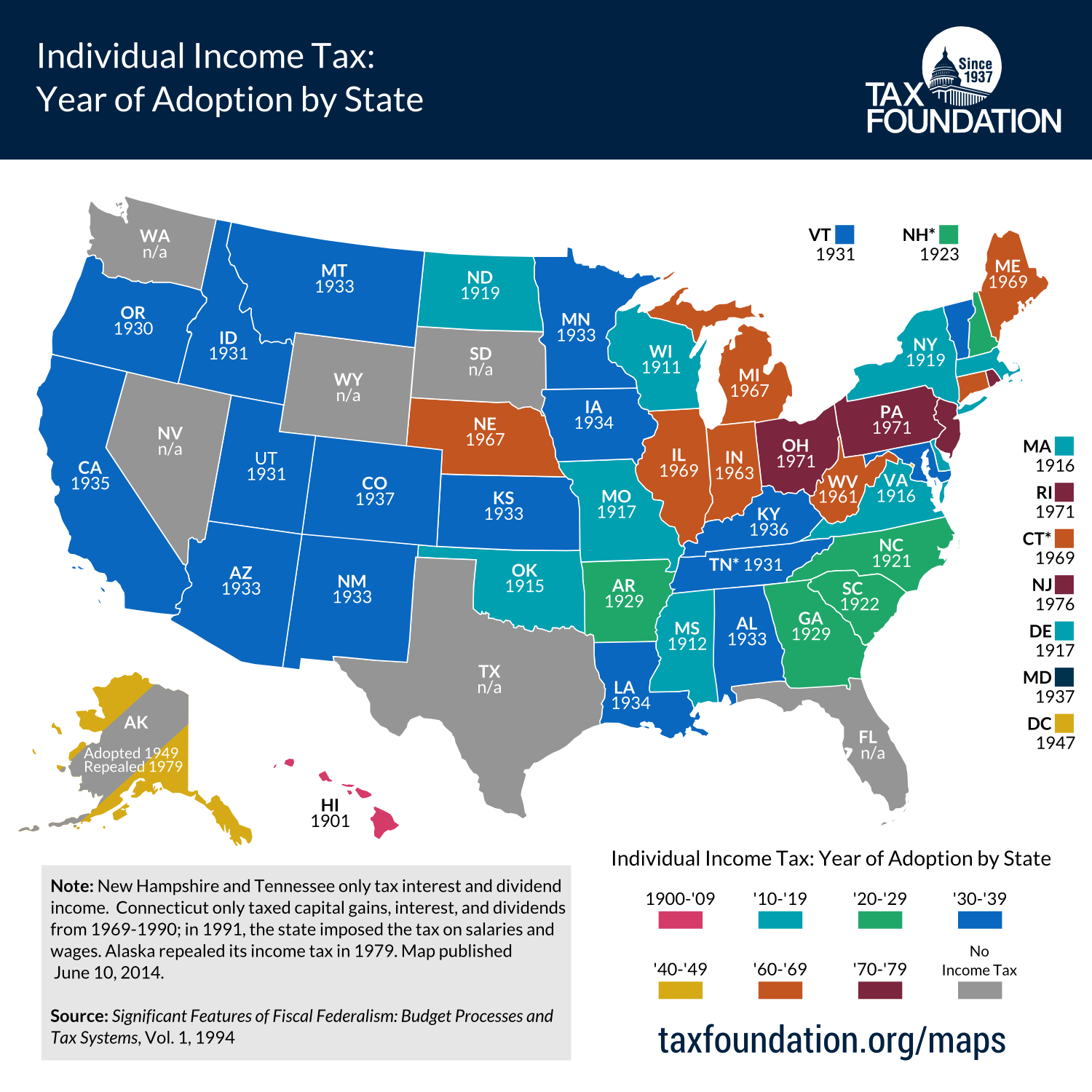

This week’s map is the adoption years of state individual income taxes. This information isn’t widely available on the internet, but we happened to have it in our archives in the 1994 edition of Significant Features of Fiscal Federalism, produced by the Advisory Commission on Intergovernmental Relations.

We’ve organized the states by decade here, and you can see that the most active one was the 1930s, where western states enacted the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. as an emergency measure as a reaction to property tax collection slumps during the Great Depression. Ten states adopted individual income taxes before 1920, with Hawaii, Wisconsin, and Mississippi even doing so before the adoption of the federal income tax in 1913. While Hawaii is technically the first state to adopt an income tax (in 1901), it’s important to mention that Hawaii was not granted statehood until 1959.

Every state has an income tax except for Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. Alaska is notable in that it is the only state to repeal an existing income tax (in 1979), while all the other states on that list have always gone without one. New Hampshire and Tennessee also deserve mention, as their income taxes do not and have not ever applied to wage income, instead only taxing interest and dividend income. Connecticut originally imposed it’s income tax on capital gains, interest, and dividends, and expanded its tax to wages in 1991.

Current income tax rates are here in a chart, and here in a map.

Share this article