(Click on the map to enlarge it. Reposting policy)

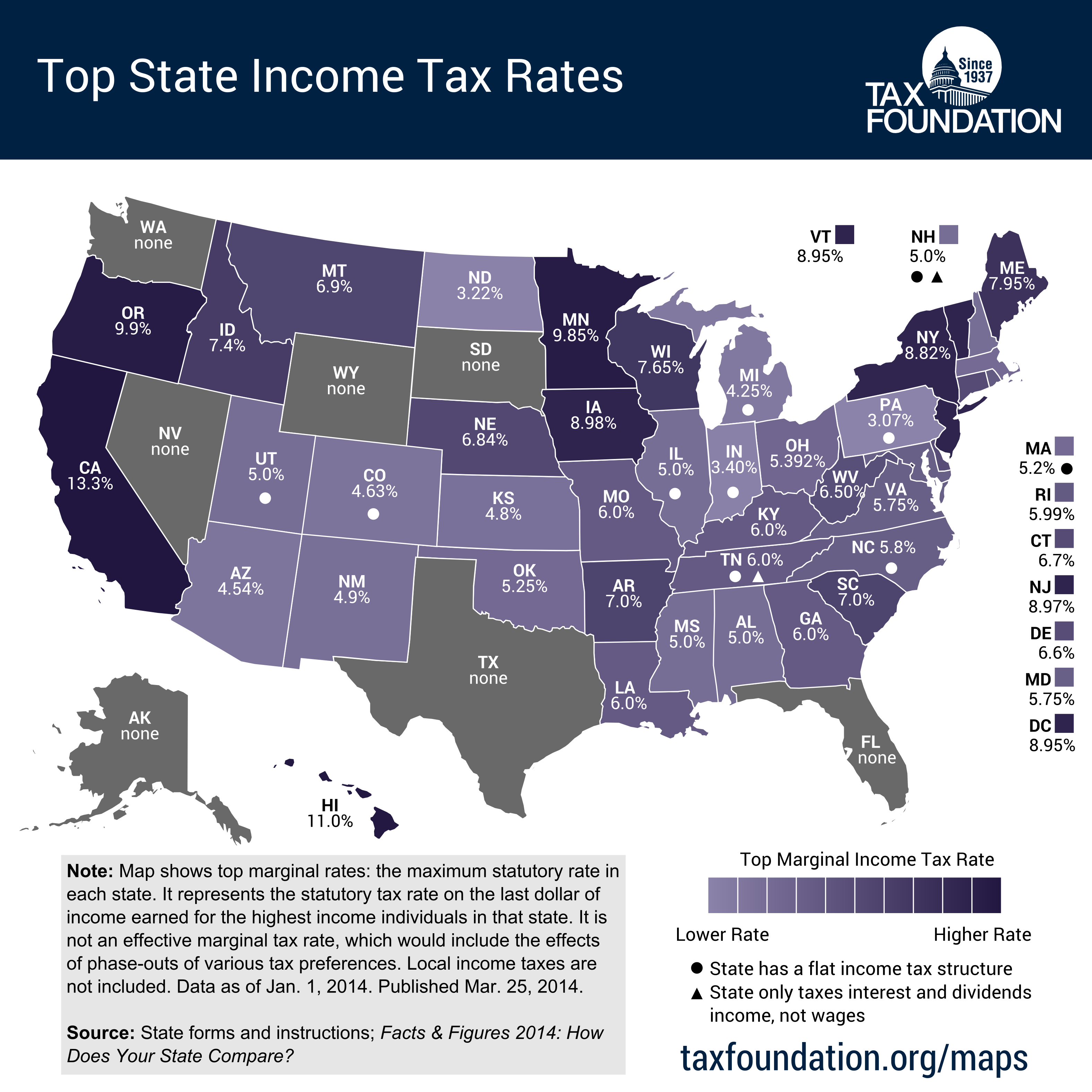

This map presents top individual income tax rates in each state for 2014. Income taxes are a major, and often complicated, component of state revenues. Furthermore, unlike sales or excise taxes which individuals pay indirectly, income taxes are levied directly on individuals, meaning that income taxes figure especially prominently in any discussion of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burdens and public policies.

Income taxes are structured in many different ways throughout the states. Some are flat systems with one rate for all income, others offer progressive systems taxing different levels of income at different rates, while some states have no income tax at all. These taxes also change: since 2013, five states (Kansas, North Carolina, North Dakota, Ohio, and Wisconsin) reduced income taxes and one state (Minnesota) increased income taxes.

For the most up-to-date data available on current state tax rates and brackets, standard deductions, and per-filer personal exemptions for individuals filing singly, see our report here.

Share this article