States tax real property in a variety of ways: some impose a rate or a millage—the amount of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. per thousand dollars of value—on the fair market value of the property, while others impose it on some percentage (the assessment ratio) of the market value, yielding an assessed value.

Some states have equalization requirements, ensuring uniformity across the state. Sometimes caps limit the degree to which one’s property taxes can rise in a given year, and sometimes rate adjustments are mandated after assessments to ensure uniformity or maintenance of revenues. Abatements are often available to certain taxpayers, like veterans or senior citizens. And of course, property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. rates are set by political subdivisions at a variety of levels: not only by cities and counties, but often also by school boards, fire departments, and utility commissions.

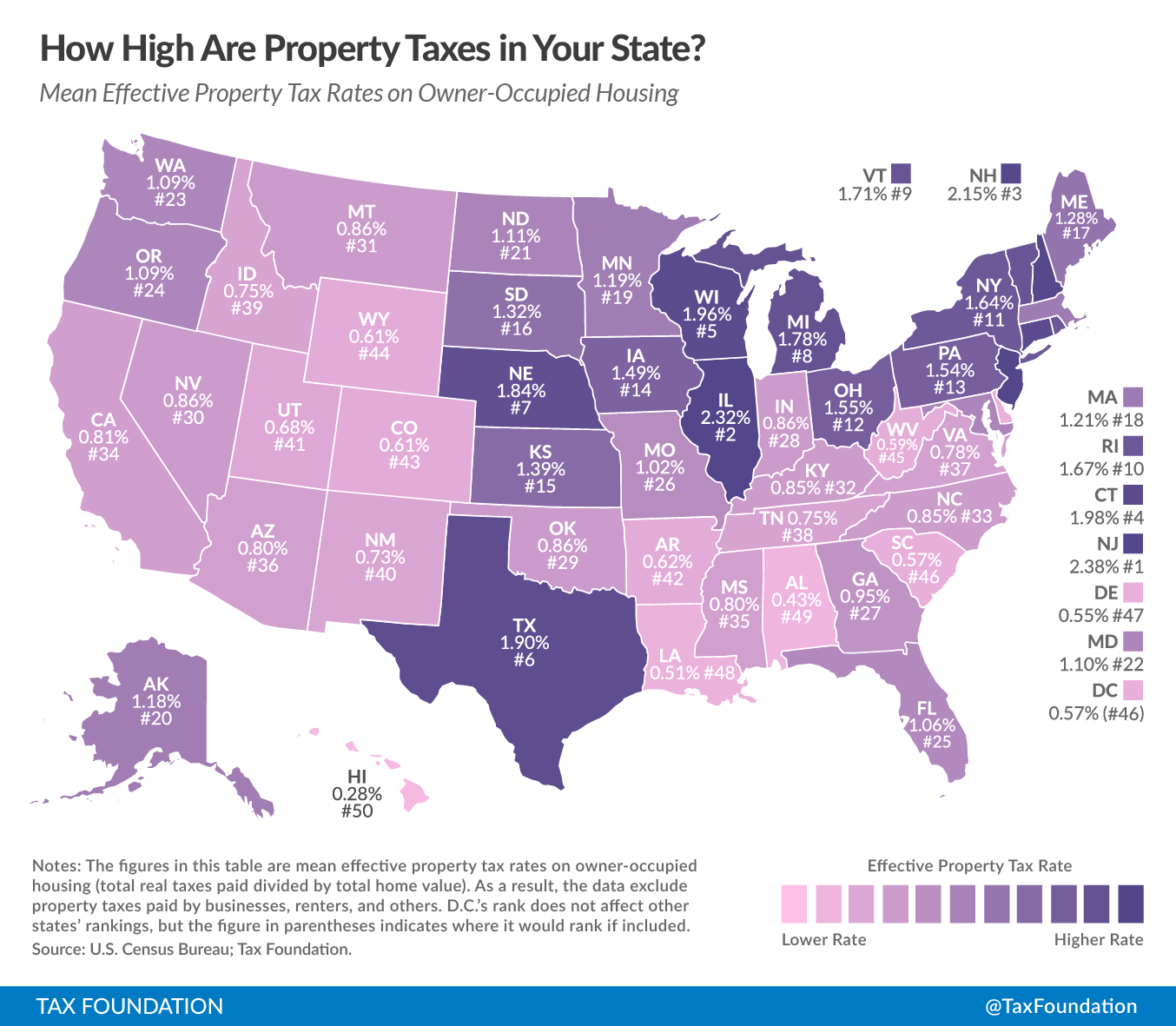

Today’s map cuts through this clutter, presenting effective tax rates on owner-occupied housing. This is the average amount of residential property tax actually paid, expressed as a percentage of home value. Some states with high property taxes, like New Hampshire and Texas, rely heavily on property taxes in lieu of other major tax categories; others, like New Jersey and Illinois, impose high property taxes alongside high rates in the other major tax categories.

New Jersey has the highest effective rate at 2.38% and is followed closely by Illinois (2.32%), New Hampshire (2.15%), and Connecticut (1.98%). On the other end of the spectrum, Hawaii has the lowest effective rate at 0.28%, and is followed closely by Alabama (0.43%), Louisiana (0.51%), and Delaware (0.55%). How does your state compare?

Share this article