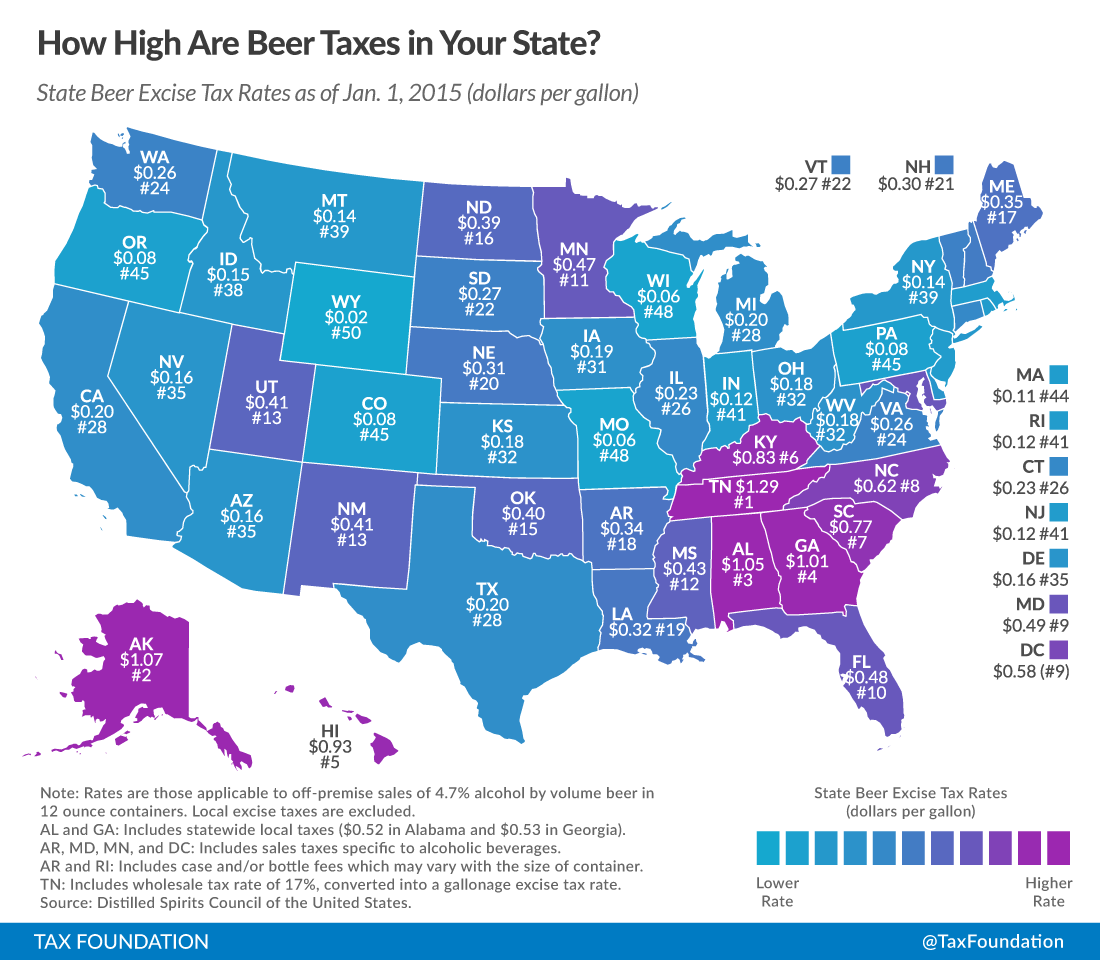

Tax treatment of beer varies widely across the U.S., ranging from a low of $0.02 per gallon in Wyoming to a high of $1.29 per gallon in Tennessee. Check out today’s map below to see where your state lies on the beer taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. spectrum.

Click on map to enlarge. (See our reposting policy here.)

State and local governments use a variety of formulas to tax beer. The rates can include fixed per-volume taxes; wholesale taxes that are often a percentage of a product’s wholesale price; distributor taxes (sometimes structured as license fees as a percentage of revenues); case or bottle fees (which can vary based on size of container); and additional sales taxes (note that this measure does not include general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , only those in excess of the general rate).

The Beer Institute points out that “taxes are the single most expensive ingredient in beer, costing more than labor and raw materials combined.” They cite an economic analysis that found “if all the taxes levied on the production, distribution, and retailing of beer are added up, they amount to more than 40% of the retail price.”

For more info on alcohol taxes, click here. For more state tax rankings, check out Facts and Figures 2015: How Does Your State Compare?

Follow Scott on Twitter.

Share this article