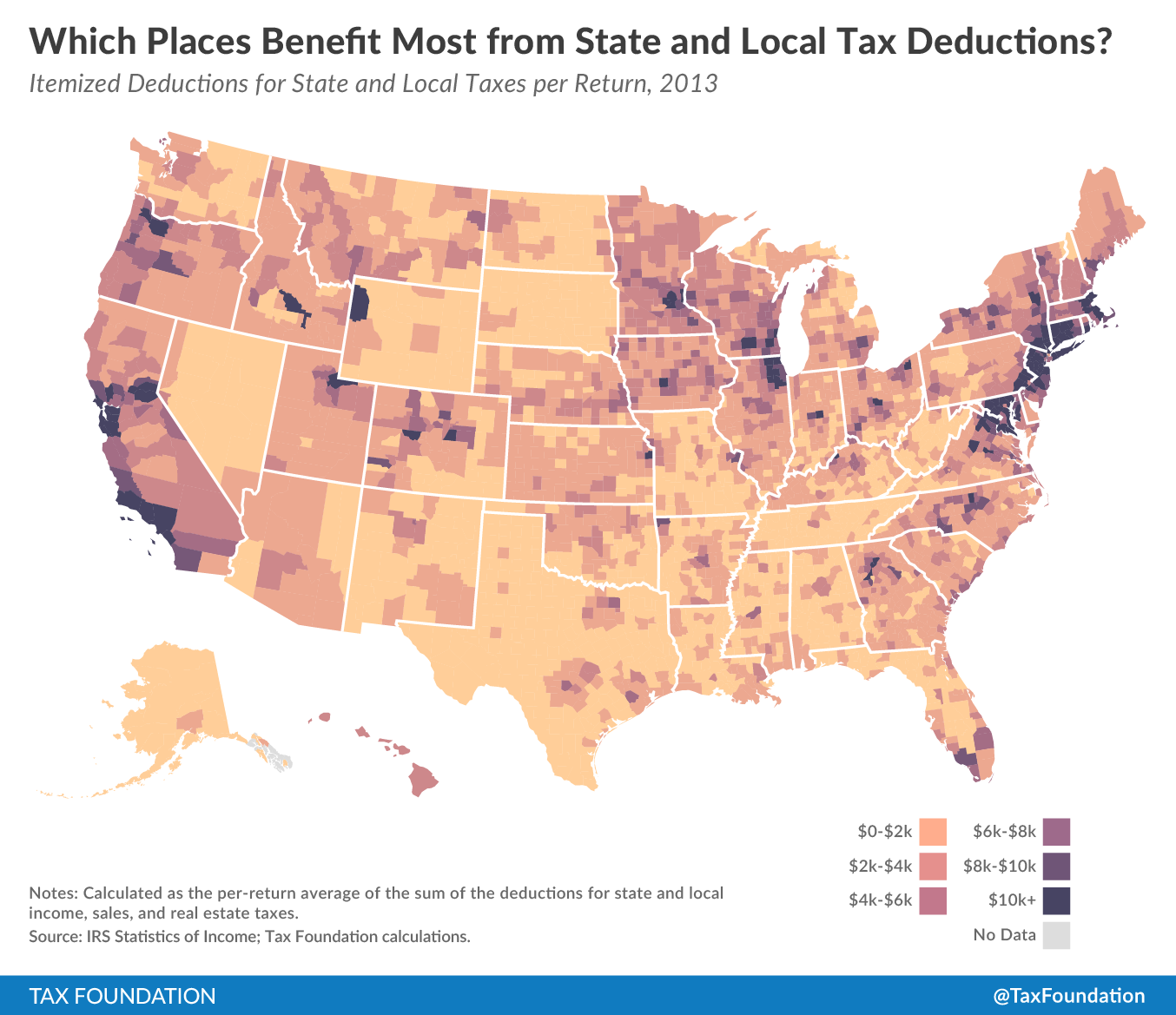

Some of the most substantial deductions in the federal tax code are the itemized deductions for state and local income, sales, and real estate taxes. This map shows the variation, by county, in the amounts of these deductions. The measurement used here is mean deduction amount taken per return: in other words, the total of all of the deductions for state and local taxes, divided by number of returns filed. The results show that the benefits of these deductions vary substantially from county to county.

There are two effects contributing to this regional variation. The first is that higher-income taxpayers tend to take larger deductions. People with very high incomes tend to have very high levels of sub-federal taxes paid. This effect is then further magnified by the fact that not everyone takes itemized deductions. Lower-income taxpayers tend to opt for the standard deduction instead. Consequently, the itemized deductions in this map are most valuable in counties where incomes are high.

The second source of county-by-county variation is that state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. regimes themselves differ substantially. The places that benefit most from this federal deduction tend to have high state and local taxes overall. One can clearly make out, for example, the border between California and Nevada, simply by looking at data from federal tax returns. The ten counties benefiting most from these deductions are all located in four states: ones that, like California, are known to have high tax burdens generally:

| County | Average State and Local Deductions Taken Per Return |

| New York County, NY | $24,652 |

| Marin County, CA | $16,130 |

| Westchester County, NY | $14,817 |

| San Mateo County, CA | $14,583 |

| Fairfield County, CT | $14,309 |

| Santa Clara County, CA | $11,949 |

| Morris County, NJ | $11,223 |

| Somerset County, NJ | $11,210 |

| Nassau County, NY | $11,204 |

| San Francisco County, CA | $10,969 |

This deduction is important to consider in light of the 2016 election; the most popular 2016 candidates are considering paring back or outright eliminating it. Jeb Bush, Ted Cruz would eliminate it outright, Bernie Sanders and a comparison of presidential tax plans.)

If this deduction were limited or eliminated in tax reform legislation, that policy choice would affect some parts of the country more than others, as the map above shows.

Share this article