Today is the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. Awareness Day. From the IRS:

“EITC Awareness Day is a one-day blitz in mainstream and social media -to reach the broadest possible range of potentially-eligible taxpayers, including taxpayer segments we believe under claim EITC and newly eligible taxpayers”

According to the IRS research in 2005, only 75 percent of eligible taxpayers take advantage of the EITC, which is approximately the same participation rate of SNAP. They believe that increasing awareness will encourage more participation.

What is the Earned Income TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Credit?

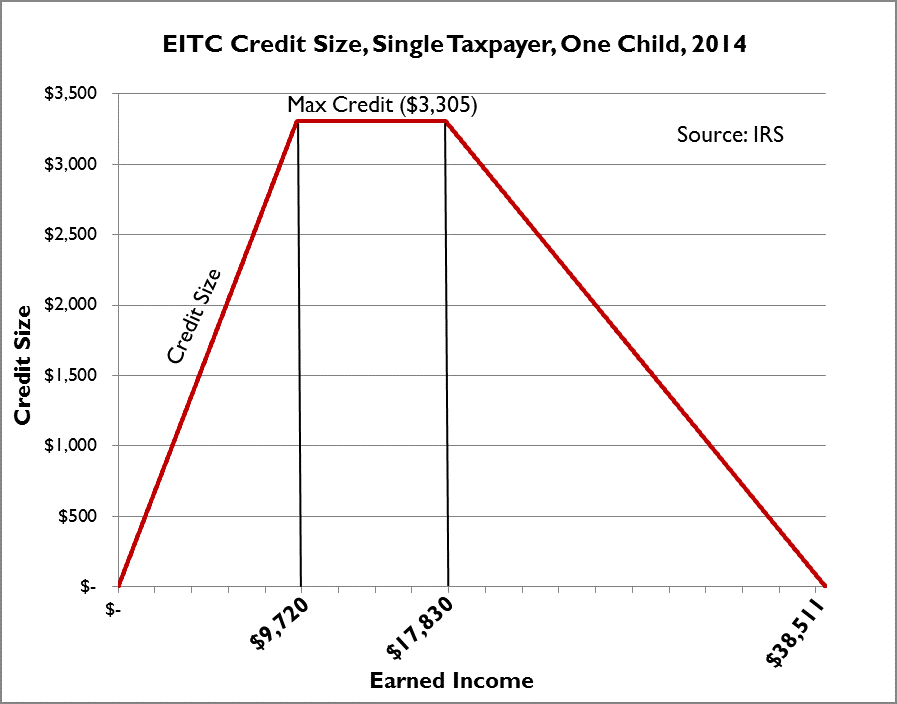

The Earned Income Tax Credit is a refundable tax creditA refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit (EITC). targeted at low-income, working individuals and families. The value of the credit varies by income and the number of children the taxpayer has. For example, a single mother with one child can receive a maximum credit of $3,305 with earned income up to $17,830.

|

2014 Earned Income Tax Credit Parameters (Source: IRS) |

|||||

|

Filing Status |

No Children |

One Child |

Two Children |

Three or More Children |

|

|

Single or Head of Household |

Earned Income Level for Max Credit |

$6,480 |

$9,720 |

$13,650 |

$13,650 |

|

Maximum Credit |

$496 |

$3,305 |

$5,460 |

$6,143 |

|

|

Earned Income Level When Phase out Begins |

$8,110 |

$17,830 |

$17,830 |

$17,830 |

|

|

Earned Income Level When Phase-out Ends (Credit Equals Zero) |

$14,590 |

$38,511 |

$43,756 |

$46,997 |

|

|

Married Filing Jointly |

Earned Income Level for Max Credit |

$6,480 |

$9,720 |

$13,650 |

$13,650 |

|

Maximum Credit |

$496 |

$3,305 |

$5,460 |

$6,143 |

|

|

Earned Income Level When Phase-out Begins |

$13,540 |

$23,260 |

$23,260 |

$23,260 |

|

|

Earned Income Level When Phase out Ends (Credit Equals Zero) |

$20,020 |

$43,941 |

$49,186 |

$52,427 |

The EITC is also structured with a phase-in, so the value of the credit increases as a taxpayer’s income increases at a regular rate. For example, that same single taxpayer with a one child would earn a larger credit for each additional dollar she earns up to $9,720. This phase-in creates a negative marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. . The credit maxes out at $3,305 (Figure, below).

However, once this taxpayer earns more than $17,830 their EITC credit will decline for each additional dollar earned over this level, creating an additional marginal tax rate. Eventually, the credit would completely phase out and be equal to zero once this taxpayer makes $38,511.

What is its Purpose?

In his State of the Union address, the President mentioned that the credit “rewards hard work.” What he means by this is that theoretically, the Earned Income Tax Credit encourages low-income individuals to earn more money through its negative marginal tax rates. The size of the credit increases for every additional dollar earned, giving the individual a greater incentive to enter the work force and increase hours. In this sense, the EITC can be seen as substitute for the minimum wage, as it subsidizes low-wage work without causing unemployment among the group it seeks to help.

Research has shown that this phase-in can increase workforce participation among certain populations.

However, when individuals make enough, the phase-out of the EITC can cause a marginal implicit tax rate, which can discourage work especially when it interacts with other welfare policies. Research from Casey Mulligan found that marginal tax rates of the EITC and other welfare programs during the recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. equaled close to 100 percent. This means that for every additional dollar of earned income, the tax payer loses $1 in government benefits. He thinks that this has contributed to the long period of high unemployment experienced during the recession.

The Tax Foundation Taxes and Growth Model shows that eliminating the EITC would raise the GDP by $33.8 billion over the long term, mainly due to the fact that the disincentive effect of the phase-out outweighs the incentive effect of the phase-in.

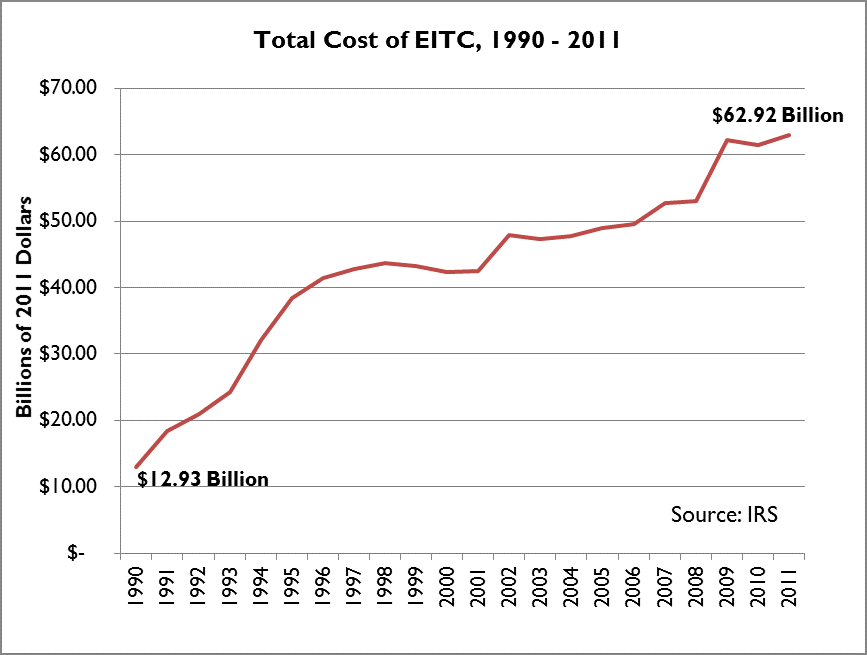

The EITC has Grown by $45 Billion over the past Twenty Years

In the past two decades, the EITC has grown consistently, except for certain years when legislation expanded the program, prompting it to grow more quickly. In total, the program has grown from $18 billion in 1990 to about $63 billion in 2011. It rapidly increased in size in 1990, 1993, 2001, and 2009, years during which the program was expanded by Congress. The most recent expansion was in the 2009 stimulus package.

EITC in the States

According to the IRS, 19.2 percent of the 146 million income tax filers in 2011 claimed the Earned Income Tax Credit across the United States. However, looking at each state, the proportion of filers in each state that claim the EITC varies based on region and income of the state. Lower-income, southern states had a higher proportion of EITC recipients than other states. Mississippi (32.8 percent), Louisiana (27.3 percent), Alabama (26.3 percent), and Arkansas (25.8 percent) had the highest proportion of EITC recipients as a percent of tax filers in those states. On the flip side, higher-income states had the lowest proportions. New Hampshire (12.2 percent), Connecticut (12.5 percent), Massachusetts (12.5 percent), and North Dakota (13.1 percent) had the lowest proportion of EITC recipients as a percent of each state’s income tax filers.

(All maps and other graphics may be published and reposted with credit to the Tax Foundation.)

(Click on the map to enlarge it. View previous maps here.)

Issue of the Marriage PenaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples.

The EITC also has a significant marriage penalty for low-income taxpayers. If a single taxpayer with a child marries another taxpayer with equal income, the value of the credit can drastically decline for the family.

Changes in 2001 and the recent stimulus plan softened the EITC’s marriage penalty, by slightly changing the earned income level that the credit begins phasing out for married taxpayers, but the penalty still exists. The full marriage penalty will return in 2017, when the temporary law expires.

Issues of Improper Payments

Another issue with the Earned Income Tax Credit is its significant amount of improper payments. Improper payments are defined as over-payments or under-payments to taxpayers. The IRS consistently has had improper payment rates over 20 percent since fiscal year 2003. The rate of improper payments has declined in recent years, but its net cost in dollar terms has increased from $9.5 billion in 2003 to $11.6 billion in 2012.

The IRS has acknowledged that this is a serious issue and has linked it to both fraud and taxpayer error: “EITC complexity leads to improper claims by taxpayers—some intentional but many inadvertent—and to improper denials by the IRS.” Research by Jeffery B. Liebman of Harvard University found that it is a mix of both, but only a minority of error was fraud. Either way, the high rate of error is concerning to many people due to its high cost and the fact that the dollars are not reaching the people they were supposed to reach.

Share this article