Lawmakers are watching the clock tick down on major provisions of the 2017 TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA). If they do not act before the end of 2025, then most Americans will face higher, more complicated taxes beginning in 2026 when major portions of the individual, estate, and business tax reforms expire. But simply extending all the expiring changes would reduce tax revenues by more than $4 trillion over the next decade, meaning lawmakers face the tough challenge of crafting legislation that preserves a better tax system without significantly worsening federal debt and deficits.

The key to that challenge is prioritizing permanence for pro-growth tax reforms while avoiding the most economically harmful payfors. Otherwise, the revenue offsets may offset the economic benefits of tax reform.

Tax Foundation’s new research outlines two pro-growth, revenue-neutral, and nearly distributionally neutral options that illustrate the difficult choices lawmakers will debate over the coming months. The two options would further broaden the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. for individual income (more so than the TCJA), maintain much of the individual rate cuts, improve the business tax base to support investment, eliminate distortive industry-specific tax credits, and maintain the corporate tax rate of 21 percent.

Unfortunately, other proposals have already surfaced that would rely on more economically damaging taxes to pay for continuation of some or all of the TCJA’s provisions, most notably through a higher corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate. Studies have shown that the corporate income tax is the most harmful tax for economic growth. And conversely, studies are now confirming the benefits of reducing the corporate income tax, finding the TCJA’s corporate tax reforms significantly boosted domestic investment. Including the average of state rates, the top combined marginal rate on corporate income under current law is 25.6 percent, already sitting higher than the OECD average (excluding the U.S.) of 23.7 percent.

A larger economy, a simpler tax code, and fiscal responsibility should be prioritized in the upcoming debates over tax policy. When policymakers target revenue-neutral tax reform, they should look to less economically damaging sources of higher tax revenues, namely through base broadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability. and ending distortive tax expenditures. Doing so has the potential to improve the tax system by reducing distortions, making it simpler to comply with and administer.

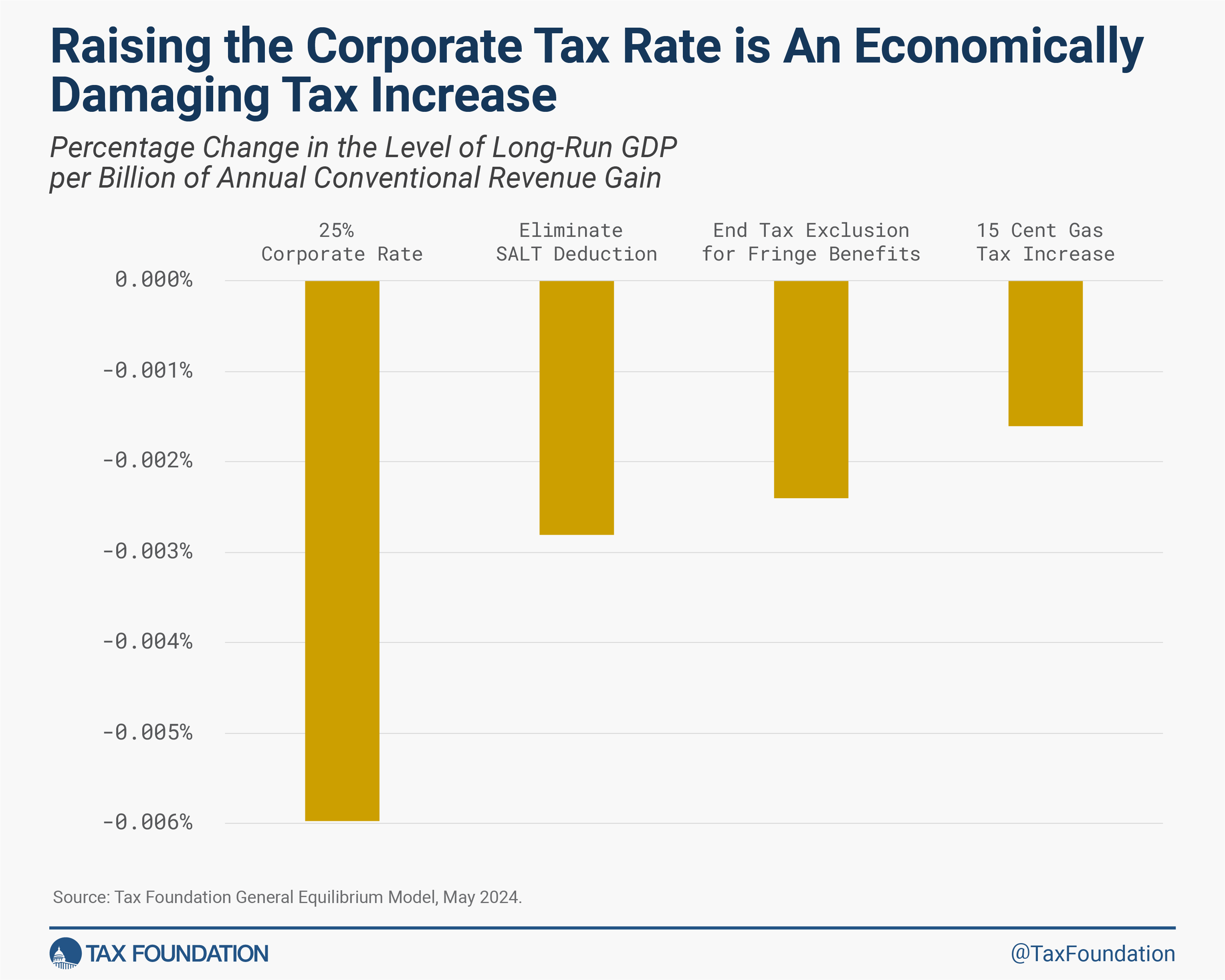

Using Tax Foundation’s General Equilibrium Model, we can compare the cost to the economy per dollar of revenue raised across different types of tax increases: eliminating the income tax exclusion for fringe benefits, eliminating the itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. for state and local taxes paid, increasing the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. by 15 cents per gallon and indexing it for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , and raising the corporate income tax rate 4 percentage points to 25 percent. Dollar for dollar, raising the corporate income tax rate is significantly more economically harmful than broadening the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. base or raising the gas tax.

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. Rather, it’s an easy payfor to cross off the list, because if lawmakers want to craft a fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe