(All maps and other graphics may be published and reposted with credit to the Tax Foundation. Click on the map to enlarge it.)

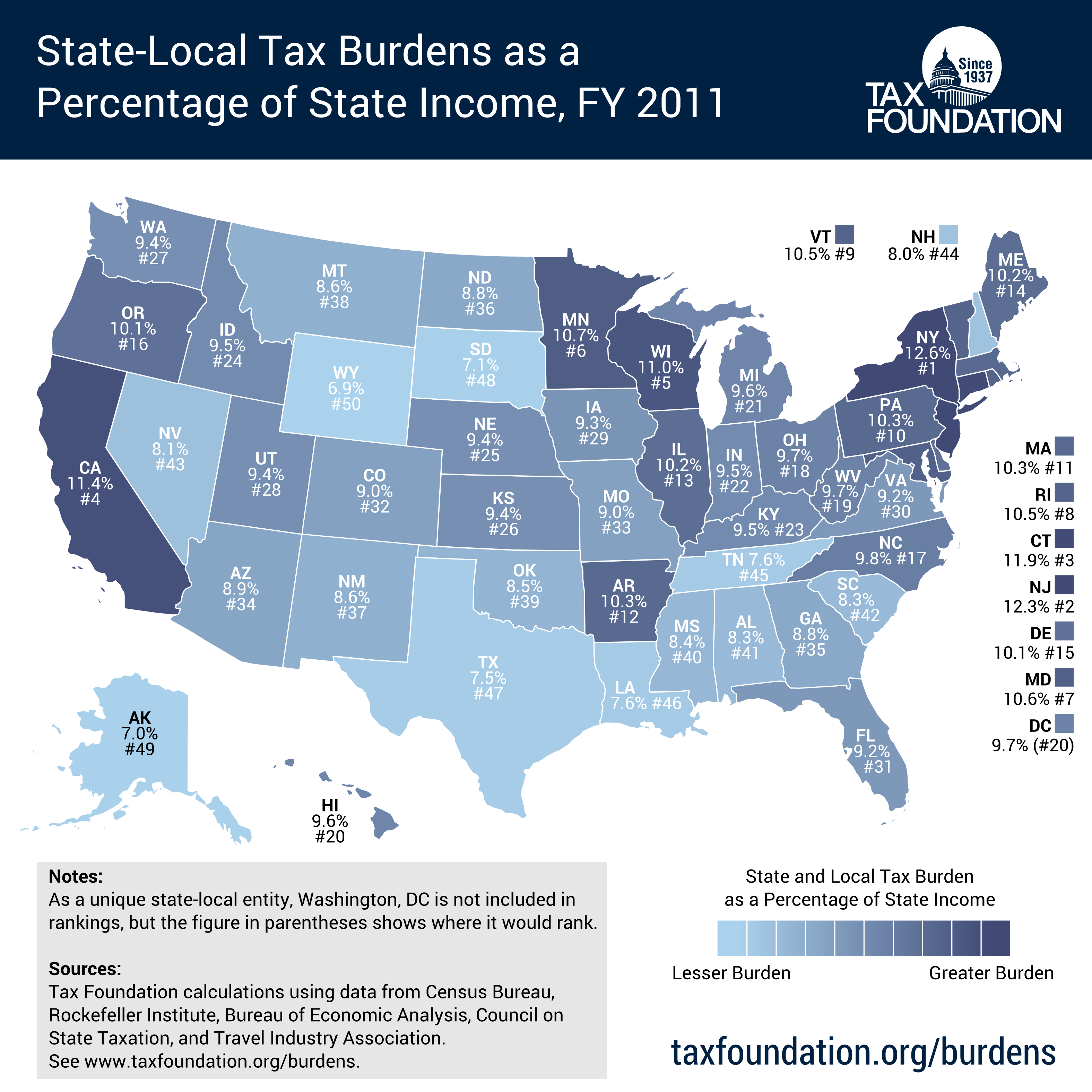

This morning, we released our Annual State-Local Tax Burdens Rankings which estimates the combined state and local tax burden shouldered by the residents of each state, regardless of the jurisdiction to which those taxes are paid. Using the most up-to-date data available, the report examines the state-local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burdens in each of the 50 states in 2011.

New Yorkers had the highest burden, paying 12.6% of their collective income in state and local taxes. New Jersey (12.3%) and Connecticut (11.9%) came in 2nd and 3rd, respectively.

On the other end of the spectrum, Wyoming (6.9%), Alaska (7.0%), and South Dakota (7.1%) have the lowest burdens.

Click here for the full report.

Share this article