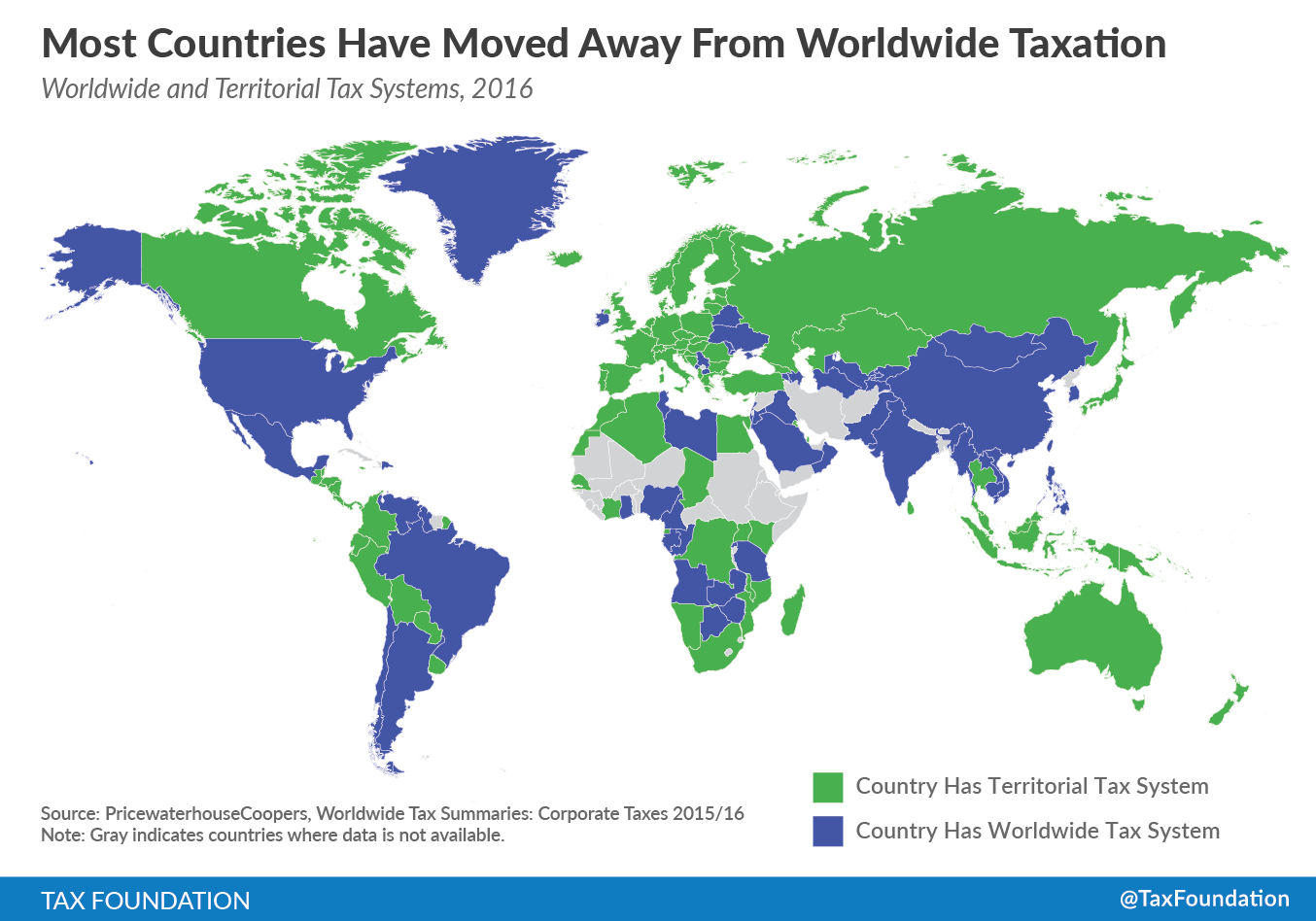

Over the past 30 years, many countries have moved away from “worldwide” tax systems that taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. their domestic corporations’ worldwide profits. Instead, many countries have what is called a “territorial” tax system. A territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base. generally allows corporations to deduct or exclude the majority of dividends received from their foreign operations. Currently, 91 countries have a territorial tax system of some kind.

As stated above, a worldwide corporate income tax system adds income earned by the foreign operations of a corporation to the taxable income of the parent. This is the system that the United States currently uses.

Suppose a U.S. corporation opens a subsidiary in the United Kingdom. The subsidiary in the United Kingdom makes $10,000 a year after labor and material costs. In the United Kingdom, corporate income is subject to a 20 percent tax. As such, the subsidiary pays the British government approximately $2,000. Then, when the subsidiary in the United Kingdom pays $10,000 in dividends to the U.S. parent corporation, those dividends are subject to the U.S. tax of 35%, or $3,500.

To prevent double taxation, the United States provides a foreign tax credit to the corporation for taxes paid in the United Kingdom. In our example, the U.S. corporation would owe $3,500 in U.S. taxes on the $10,000 in dividends that the subsidiary in the United Kingdom remitted. However, the corporation would be able to credit the $2,000 in taxes it already paid to the British government. Thus, the U.S. corporation would pay $1,500 to the IRS, $3,500 minus $2,000.

If the United States had a territorial tax system, the result would have been different. Specifically, the U.S. corporation would not have to pay any additional tax to the IRS on the income earned in the United Kingdom.

The difference between a territorial and a worldwide tax system becomes important when, for example, a French corporation is competing with an American corporation in the United Kingdom. The American corporation would have a higher tax burden despite earning income from the same source as the French corporation. Therefore, American multinationals are put at a disadvantage over corporations domiciled in other countries due to cost differences.

However, this competitiveness concern is partially mitigated by one other important aspect of the U.S.’s worldwide system: deferral. The United States, and many other countries with a worldwide tax systems, only taxes foreign income when it is remitted to the parent corporation. However, this same policy that quells competitiveness concerns creates another issue: the lockout effect — because U.S. companies (and companies based in other countries with worldwide tax systems) can defer the taxation of foreign earnings by keeping them overseas.

Many countries don’t deal with this issue anymore because of their move to a territorial tax system.

Of course, the distinction we make here between territorial and worldwide in the map is a simplified version of what is happening around the world. The way we distinguish between the systems is simply their treatment of dividends received from foreign controlled corporations. Countries’ tax systems have many other characteristics. Many other sources of foreign income may still be taxed; some countries tax worldwide passive income, and some countries limit their territorial tax system to dividends received from subsidiaries in specific countries.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe