The United States has long been a forward-thinking country that builds for tomorrow through saving, investment, and entrepreneurship. Saving gives us security, investment gives us rising incomes through enhanced productivity, and entrepreneurship drives economic growth and dynamism, creating new opportunities.

However, over the last fifty years, all three have been eroded. Citizens aren’t saving enough, businesses aren’t investing enough, and the country is undergoing a retreat in the level of economic growth and dynamism.

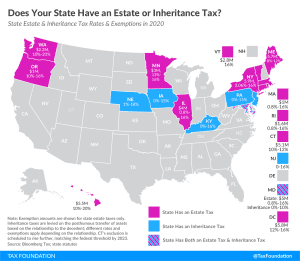

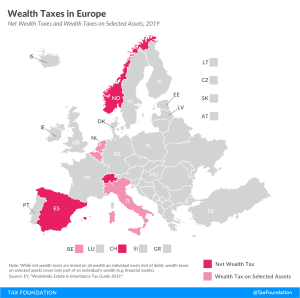

As it is, the U.S. tax code places substantial burdens on each of these essential factors of our economy. What’s worse, while other nations have become more attractive, there has been a proliferation of proposals in the U.S. that would only cause further harm—wealth taxes, “mark-to-market” capital gains taxes, estate taxes, and financial transaction taxes.

Below, we offer in-depth analysis of these and other proposals, which highlight a harmful trend in tax policy. Americans are industrious, entrepreneurial, and innovative. Policymakers should ensure we have a tax code that enhances those qualities, not hinders them.