This week is National Small Business Week. From the U.S. Small Business Administration (SBA) website:

“Every year since 1963, the President of the United States has issued a proclamation announcing National Small Business Week, which recognizes the critical contributions of America’s entrepreneurs and small business owners.”

Small businesses are important to the U.S. economy. According to the SBA, “more than half of Americans either own or work for a small business, and they create about two out of every three new jobs in the U.S. each year.”

Most small businesses are what are called “pass-through” businesses. These businesses get their name because their profits are passed through the business directly on to the owner’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. return, who then pays tax on that income. These business can be sole proprietorships, partnerships, LLCs, and S corporations.

Since pass-through income is passed-through to their owners, these businesses face the same taxes as individuals. They need to pay federal, state, and local income taxes, payroll taxes, and other taxes on income such as the Alternative Minimum Tax and the Net Investment Income Tax.

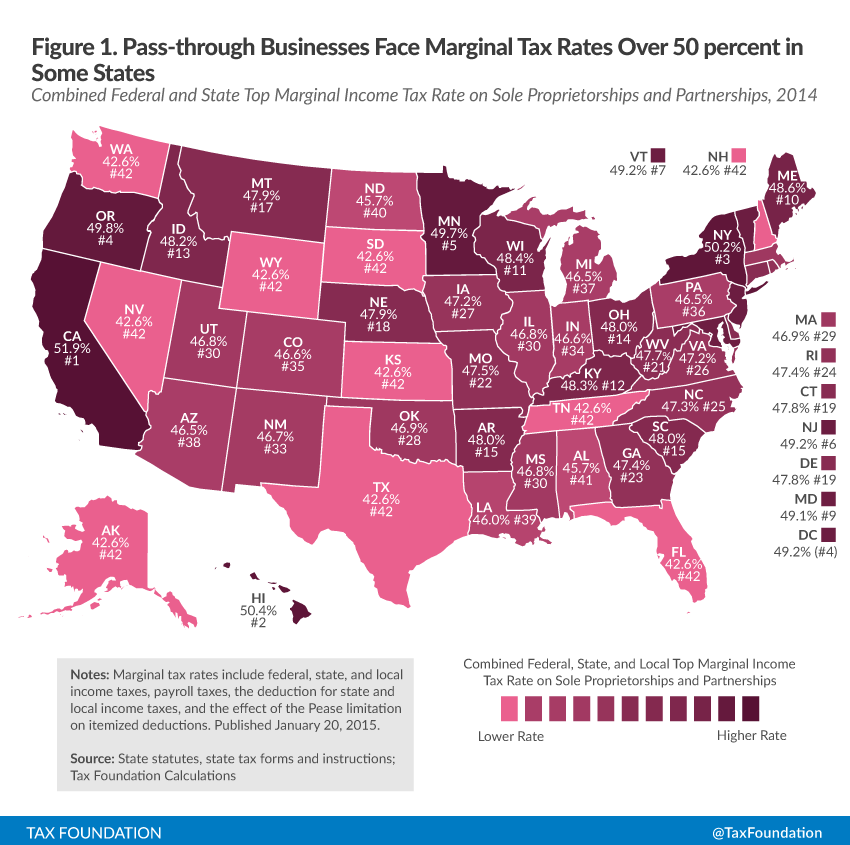

Combined, these taxes can hit a small business hard when it eventually grows and earns more income. In California, for example, the top marginal income tax rate on pass-through businesses tops 51.9 percent. Hawaii (50.4) and New York (50.2 percent) also have top marginal tax rates on pass-through businesses over 50 percent. Even in states with no income tax, the top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income is 42.6 percent.

For more information on pass-through businesses, see our report: “An Overview of Pass-through Businesses in the United States.”

Share this article