There are five basic legal forms of business structures found in the United States: C corporations, S corporations, sole proprietorships, partnerships, and Limited Liability Companies (LLCs). In order to understand business income taxes, we can start with how the business forms are different. We can divide the five business forms into two big groups: C corporations and pass-through businesses depending on whether they are subject to double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. .

C Corporations

A corporation is an independent legal entity owned by its shareholders. The entity remains the same even through the change of shareholders (This makes it easier to buy and sell the companies’ shares.) Under the corporate form, the shareholder’s liability is limited to the amount of his or her investment. There are two types of corporations in the United States: C corporations and S corporations. C corporations and S corporations share many legal rules as corporations, but they differ significantly in taxation.

The profit of a C corporation is taxed twice. First, it is taxed as business income with the company paying the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . Second, it is taxed at the shareholder level when distributed to shareholders as dividends.

Pass-through Businesses

Pass-through businesses do not pay taxes at the business level. Instead, profits or losses are passed through to the owners and partners and are taxed at individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates.

There are three main types of pass-through businesses: sole proprietorship, partnerships, and S Corporations.

S corporations are a special type of corporations which elect to (by filing Form 2553) pass corporate income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income stream. S corporations can have up to 100 shareholders.

A sole proprietorship is an incorporated business owned by a single person. A partnership is similar to a sole proprietorship in function but allows for the association between two or more persons who agree to combine their resources and skills for a mutual profit (and loss).

Although the three types of business structures differ a lot in organizational forms, the impact of taxes on them is quite similar.

Limited Liability Companies

An LLC is a hybrid business form with characteristics of both corporations and partnerships. LLCs have become very popular since 1980s due to its flexibility and simplicity. Every state has its own statute on LLCs, so the federal government does not recognize it as a business entity for federal taxation purpose. However, most LLCs can choose their federal business entity classification. Most LLCs choose to be treated as pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. in order to avoid double taxation. For example, LLCs made up 66.3 percent of all partnership tax returns in 2011.

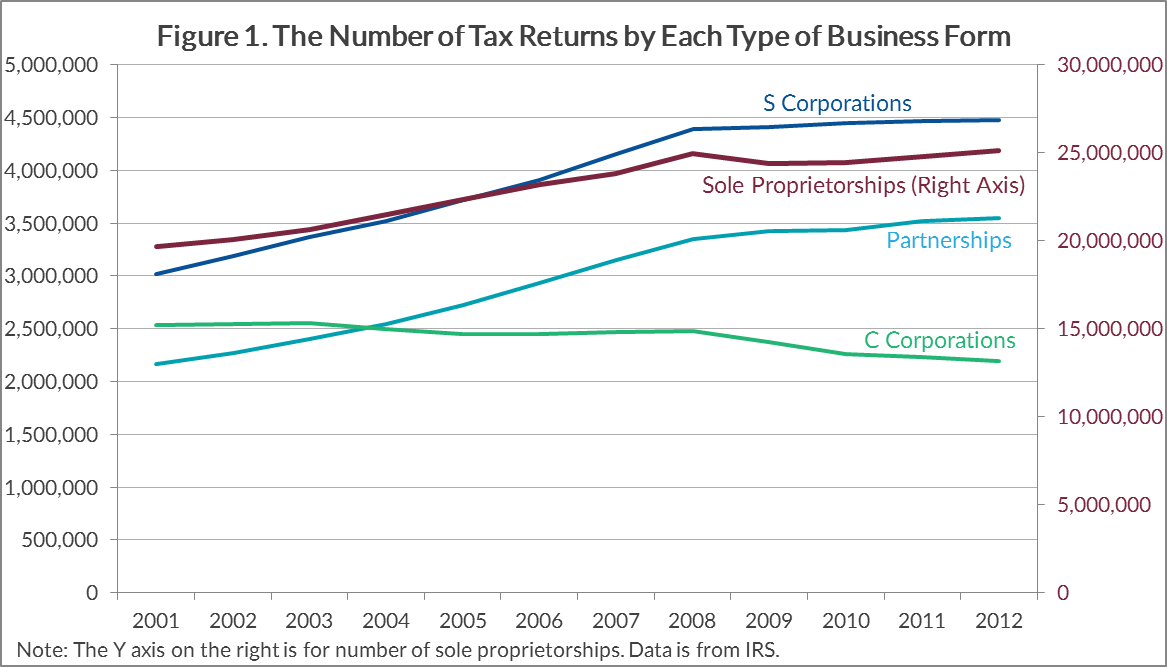

Figure 1 presents the number of returns in different business forms from 2001 to 2012. Sole proprietorships have the largest number of returns. Over this timeframe, C corporations were the only business form that shrunk in number of firms.

For more C corporations and pass-through business, see here and here.

Share