People often think of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue as a function of tax rates. If you want to raise more tax revenue, raise tax rates. If you don’t want to lose revenue, don’t cut tax rates.

Reality isn’t so simple. Instead, economic growth is often the key driver of tax revenues.

The U.S. and UK Experience

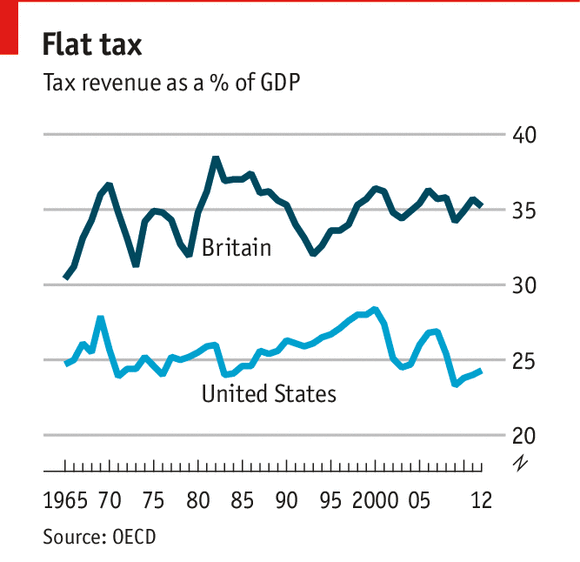

A recent article in The Economist pointed out that since 1965 tax revenue in the United States and the United Kingdom have remained fairly stable, despite multiple significant tax increases and tax cuts:

“Britain has seen the introduction of VAT under Edward Heath, a slashing of top rates under Margaret Thatcher and most recently, an attempt to take lower-paid people out of the tax net. Through all this, the tax take has never fallen below 30.5% or risen above 38.5%. The smallest tax take was back in 1965, and the peak, surprisingly, was in 1982 under Margaret Thatcher. Since the start of the millennium, the range has been very narrow – between 34.4% and 36.4%.

“America has seen high top rates of tax in the 1970s, followed by Reagan tax cuts, Clinton tax increases and Bush junior cuts. None of it made much difference to the overall take. The two years with the lowest take were under the supposedly “socialist” Obama (admittedly a function of the weak economy) and the highest tax take was under Clinton, at the height of the dotcom boom in 2000.”

The chart of U.S. and UK revenues tells the same story. Since 1965, tax revenues in the UK have fluctuated between about 30 and 38 percent and have stuck near 35 percent for the last 15 years. Over the same period, tax revenues in the U.S. have fluctuated between about 23 percent and 28 percent.

Government in both places have seen revenue act independently of tax rates in some instances.

In the United States through the 1960s and 1970s, top individual federal tax rates remained at 70 percent while revenue climbed to 27.9 percent in 1969 before dropping to 23.9 percent in 1971. Following the recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. in 1981 and 1982, tax revenue dropped to 24 percent, then climbed steadily through 2000, despite top marginal income tax rates coming down to 28 percent and the corporate rate dropping to 34 percent in 1986. Tax revenue fell in the early 2000s before and after the 2001 Bush tax cuts, only to rise again after the 2003 Bush tax cut.

What Drives Tax Revenues?

As The Economist writer implies, economic growth is a major driver of the level of tax revenues. In the times when tax revenues are up, the economy is doing well. When tax revenues are down, it’s because the economy is doing poorly.

We see this in each of the times when revenue fluctuates. From the mid-1980s through the late 1990s the economy grew steadily and tax revenues grew along with it. Conversely, between 2007 and 2009, total tax revenue in the U.S. dropped from 26.9 percent of GDP to 23.3 percent of GDP. The driver: the financial crisis and great recession.

How Do We Maximize Tax Revenue?

The short answer to how we maximize tax revenue: increase economic growth. We can do this by limiting taxes on economic factors that drive economic growth, namely investment. This means reducing tax rates on businesses, limiting the double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of investment created by taxing corporate income at both the entity level (corporate tax) and the shareholder level (capitals gains and dividend taxes), and moving toward full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. (which would allow businesses to account for all their costs).

In the long-term, both cutting the corporate tax rate to 25 percent and moving to full expensing would lead to increased total federal tax revenue in the long term due to more jobs, higher wages, and more economic activity.

In the end, we can maximize total tax revenue by moving away from economically inefficient taxes such as corporate taxes and long depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. lives and toward taxes that collect revenue without damaging economic growth.

Share this article