Idaho’s Tax Hiking Ballot Measure Is Riddled With Mistakes

Idaho Ballot initiative would impose an incredibly high top marginal rate that would fall on many small businesses, not just high-income earners.

7 min read

Idaho Ballot initiative would impose an incredibly high top marginal rate that would fall on many small businesses, not just high-income earners.

7 min read

Among the 46 states that held legislative sessions this year, structural state tax reform and temporary tax relief measures were recurring themes.

13 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

While the bulk of the proposed tax increases and spending programs remain under debate, Democratic lawmakers have reportedly agreed on prescription drug pricing provisions as a starting point for a revived Build Back Better package.

3 min read

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

On July 1st, 2021, over 130 countries agreed to an unprecedented 15% global minimum tax. One year later, the deal appears stuck. Daniel Bunn joins Jesse to discuss what this delay means for countries and multinational corporations, and what the path ahead looks like for global tax policy and competition.

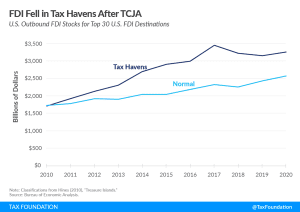

Overall, the data shows outbound FDI shifted from low-tax to other jurisdictions, while inbound FDI remained largely unchanged.

3 min read

Gov. Stitt signed into law a pro-growth bill that will set the state apart from its peers. Other states should look to follow Oklahoma’s example and make full expensing permanent to maintain their competitiveness in an increasingly mobile economy.

3 min read

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

Although the dispersion of our supply chains throughout the world has been scrutinized in recent years, both inbound and outbound foreign direct investment are critical to sustaining supply chain resiliency and reducing economic risks for both firms and investors.

5 min read

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

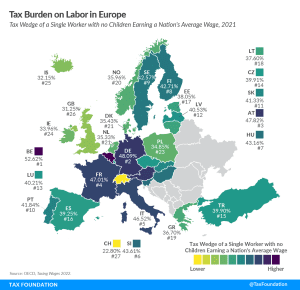

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Oil prices have skyrocketed, posing a new risk to the post-pandemic recovery. Feeling the pressure to respond, policymakers have proposed everything from gas tax holidays, tapping into strategic reserves, and even rebate cards. One idea that has crawled back from the dead: “Windfall Profits Taxes.” This idea is seemingly simple: legislation targeted at the “excess” profits of oil companies. However, as with anything in tax policy, the reality is much more complicated.

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read