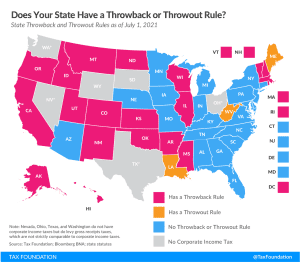

Throwback and Throwout Rules by State, 2022

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read