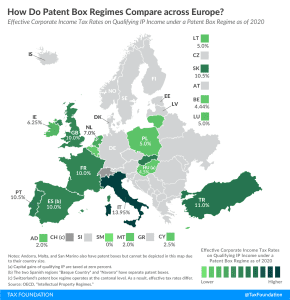

Patent Box Regimes in Europe, 2020

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

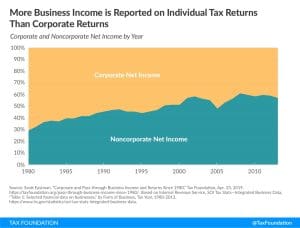

Economists have proposed taxing corporate income more uniformly through corporate integration, which can be done in a variety of ways. Biden’s plan goes in the opposite direction by making worse the double taxation of corporate income.

5 min read

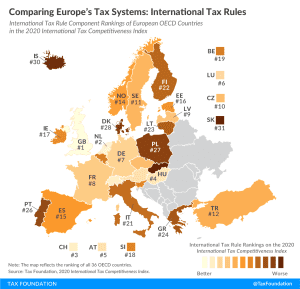

International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of a country’s tax code.

3 min read

While there are many tax changes built into the tax code over the coming years for individuals and businesses, the recent claim that lower- and middle-income Americans may see a “stealth tax increase” in 2021 due to the Tax Cuts and Jobs Act (TCJA) is untrue.

3 min read

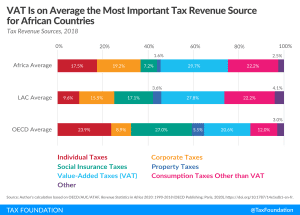

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

We sat down with the owners of Black Narrows Brewing Company, a family-owned craft brewery situated in a small island-town on Virginia’s scenic Eastern Shore, to discuss the challenges they face as a small business during COVID-19 and what they would like to see legislators do to reduce short- and long-term barriers for entrepreneurs.

Biden has not specified how he would approach the Trump tariffs, though his advisers have said he will at least review them.

5 min read

What do election results mean for the future of the federal tax code? What role will tax policy play in curbing the economic effects of the COVID-19 pandemic? How should policymakers address the federal deficit and could a carbon tax be part of that solution? How much of President-elect Joe Biden’s pre-election tax plan will actually come to pass?

There has been an ongoing debate about how automation and the use of robots in the workplace has impacted workers’ wages and employment. Recently, MIT and Boston University economists examined whether tax policy favors certain forms of automation that puts workers at a competitive disadvantage.

7 min read

A recent Deutsche Bank analysis proposes a federal work-from-home tax (“privilege tax”), which is designed to strip away the financial benefit of remote work.

5 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

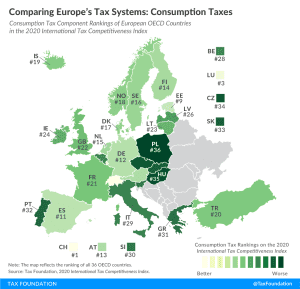

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

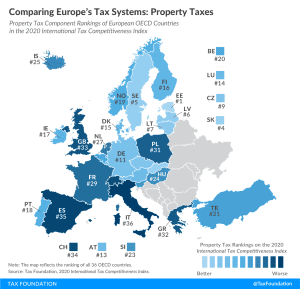

In Tuesday’s election, voters in two states—California and Colorado—were tasked with deciding whether to amend their states’ constitution to change how the property tax burden is distributed. In many ways, the ballot measures were mirror images of each other, but the outcomes were similar.

3 min read

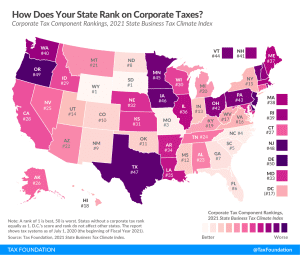

The corporate tax component of our Index measures each state’s principal tax on business activities. Most states levy a corporate income tax on a company’s profits (receipts minus most business expenses, including compensation and the cost of goods sold), while some states levy gross receipts taxes, which allow few or no deductions for a company’s expenses.

2 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

Increasing the corporate tax rate is often offered as a solution to income inequality because higher-income individuals tend to own more corporate shares than others and may bear the burden of a tax increase on corporate income.

4 min read