All Related Articles

Ensuring Tax Rates Don’t Rise with Inflation

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

Taxes and the UK’s new Prime Minister

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

New Mexico and the Question of Tax Competitiveness

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

Accounting for the New Book Minimum Tax

The Inflation Reduction Act includes a book minimum tax, which is raising the eyebrows of accountants everywhere. Scott Dyreng, a professor of accounting at Duke University, and Daniel Bunn join Jesse to discuss how these minimum taxes work and how companies aim to comply with all these new complex rules and tax increases.

The Economic, Revenue, and Distributional Effects of Permanent 100 Percent Bonus Depreciation

The phaseout of 100 percent bonus depreciation, scheduled to take place after the end of 2022, will increase the after-tax cost of investment in the U.S. Permanently extending it would increase long-run economic output by 0.4 percent and increase employment by 73,000 FTE jobs.

20 min read

IRS Is Raising More with Less, But New Funding Misses the Mark

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections (FY 2020)

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

The Tax Compliance Costs of IRS Regulations

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read

“Taxing Big Oil Profiteers Act” Risks Disincentivizing Production, Inventory

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

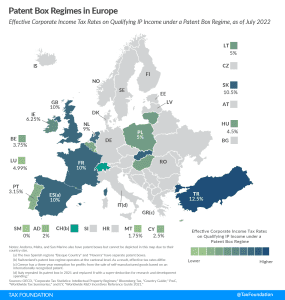

Patent Box Regimes in Europe, 2022

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read

Arkansas’s Rate Reduction Acceleration

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

How to Think About IRS Tax Enforcement Provisions in the Inflation Reduction Act

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read

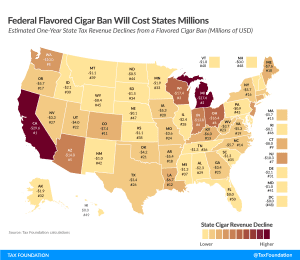

FDA Ban on Flavored Cigars Could Cost $836 Million in Annual Excise Tax Revenue

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read

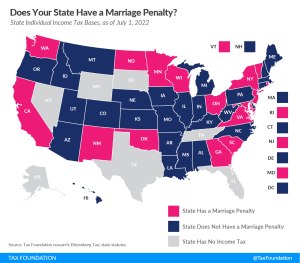

Does Your State Have a Marriage Penalty?

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers. In other words, married couples who file jointly under this scenario have a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

3 min read

Stock Buyback Tax Would Hurt Investment and Innovation

The Inflation Reduction Act calls for a new 1 percent excise tax on stock buybacks, the argument being it would be better for the economy if firms invested their surplus cash in the business, rather than returning this value to shareholders.

3 min read

House Votes on the Inflation Reduction Act

The House of Representatives is set to pass the Inflation Reduction Act, the latest iteration of President Biden’s tax and climate agenda. Garrett Watson joins Jesse to discuss what sacrifices were made by key lawmakers to bring this bill to the finish line. They also look at what the economic impact of this proposal would be as the country continues to face historic rates of inflation.

Who Gets Hit by the Inflation Reduction Act Book Minimum Tax?

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read