All Related Articles

To Stimulate R&D Investment, Stop Penalizing it in the Tax Code

In his State of the Union Address, President Biden called for leveling the global research & development (R&D) playing field by increasing federal R&D spending, specifically by asking Congress to pass the bipartisan United States Innovation and Competition Act (USICA).

3 min read

Accounting for the Global Minimum Tax

Double taxation impacts the ability of companies to invest valuable things like improving their supply chains, developing new products, and hiring workers, and it can be fixed if the minimum tax uses a country’s own tax rate.

8 min read

Post-Versailles Declaration: Tax Policy in the Future of European Energy Security

The unified EU signing of the “Versailles Declaration” is a historic break from the past. Russia’s war against Ukraine has made energy (and related tax policies) an even more urgent focus for the EU.

6 min read

Iowa Enacts Sweeping Tax Reform

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

Tax Reform Framework Would Improve Nebraska’s Competitiveness

If Nebraska is to create a competitive environment and attract in-state investment, comprehensive tax modernization must be a priority.

9 min read

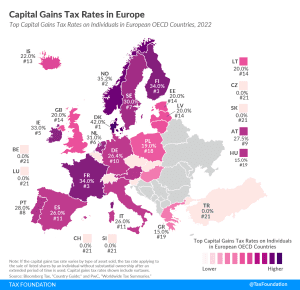

Capital Gains Tax Rates in Europe, 2022

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read

Missouri’s Tax Competitiveness

While Missouri has room for improvement, the state is making waves, positioning itself as an increasingly attractive location for business investment. And as ongoing reforms further enhance the competitiveness of the state’s tax code, more businesses will take notice.

8 min read

A Regulatory Tax Hike on U.S. Multinationals

While much of the policy focus has been on proposals embedded in the Build Back Better agenda, a meaningful tax hike for multinational companies has already been adopted.

1 min read

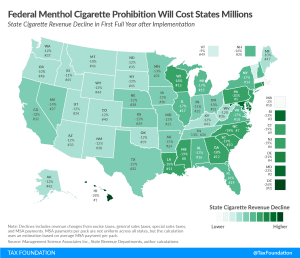

Federal Menthol Cigarette Ban May Cost Governments $6.6 Billion

The FDA’s expected announcement of a national ban on menthol-flavored cigarettes and cigars with a characterizing flavor would carry significant revenue implications for both the federal government and state governments, with likely limited benefits in smoking cessation.

6 min read

The Global Minimum Tax Changes the Game for Build Back Better Revenue

One goal for the Build Back Better Act has been to increase the amount of revenue the U.S. raises from U.S. companies at home or abroad. With the global minimum tax rules in play, it is likely that the expected gains to the U.S. Treasury from foreign profits of U.S. companies will diminish.

5 min read

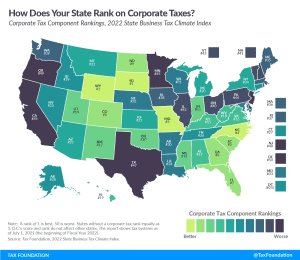

Ranking Corporate Income Taxes on the 2022 State Business Tax Climate Index

Unlike other studies that look solely at tax burdens, the State Business Tax Climate Index measures how well or poorly each state structures its tax system. It is concerned with the how, not the how much, of state revenue, because there are better and worse ways to levy taxes.

4 min read

Rushing Headlong into Formulary Apportionment

Complex tax policies that work well “in theory” can often have a hard time when the rubber meets the road. One instance of this is the challenge that the OECD has created for itself with the global tax deal, also fondly known as Pillar 1 and Pillar 2.

7 min read

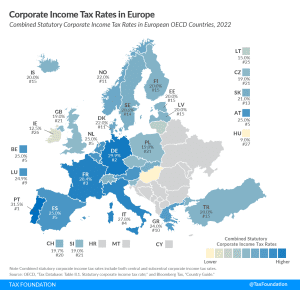

Corporate Income Tax Rates in Europe, 2022

Portugal, Germany and France have the highest corporate tax rates in Europe. How does your country compare?

2 min read

10 Tax Reforms for Growth and Opportunity

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

Proposal to Rid Ohio of Gross Receipt Taxes

A group of lawmakers in Ohio have proposed to repeal the state’s gross receipt tax (GRT), also known as the commercial activity tax (CAT).

5 min read

Sources of U.S. Tax Revenue by Tax Type, 2022 Update

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min read