Summary and Analysis of the OECD’s Work Program for BEPS 2.0

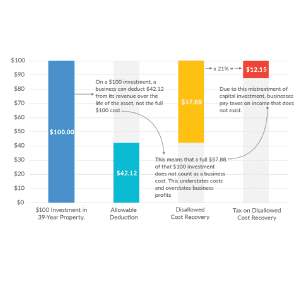

From a broad standpoint, agreement at the OECD will require countries to give up some measure of their own tax sovereignty on policies they have designed to minimize the distortionary effects of the corporate income tax. Over the years tax competition has led to some countries adopting policies that are attractive to businesses because they have a more neutral rather than distortionary approach to taxing corporate income. This project could directly undermine that progress by introducing new levels of complexity and distortion that would ultimately have a negative impact on global trade and growth.

34 min read