All Related Articles

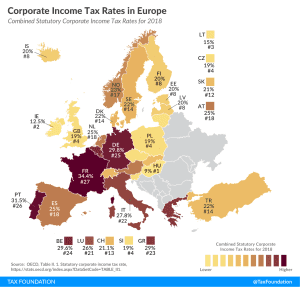

Opportunities for Pro-Growth Tax Reform in Austria

Austria needs to pursue comprehensive business and individual tax reform if it wants to remain competitive. Our new guide explores several ways the Austrian government can achieve a simpler, more pro-growth tax code.

10 min read

Ready to go on BEPS 2.0?

8 min read

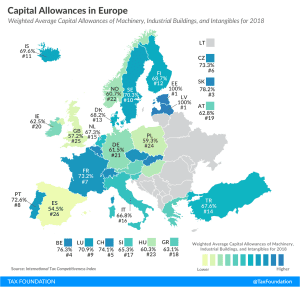

Capital Allowances in Europe, 2019

3 min read

Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform

Despite tax cuts in recent years, Wisconsin’s overall tax structure lags behind competitor states in simplicity, tax rates, and business climate for residents and investment. Explore our new comprehensive guide to see how the Badger State can achieve meaningful tax reform.

11 min read

Amortizing Research and Development Expenses Under the Tax Cuts and Jobs Act

Expensing, or the immediate write-off of R&D costs, is a valuable component of the current tax system. The TCJA’s change to amortization in 2022, requiring firms to write off their business costs over time rather than immediately, would raise the cost of investment, discourage R&D, and reduce economic output.

12 min read

A High Tax Rate on Star Inventors Lowers Total Innovation

Findings from a new study suggest that while a policy agenda to revive innovation must include an assortment of changes – including greater access to mentorship – tax policy matters too.

2 min read

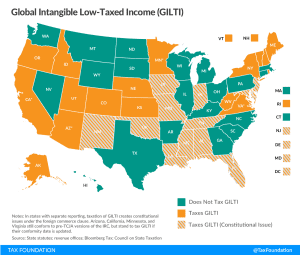

GILTI Minds: Why Some States Want to Tax International Income—And Why They Shouldn’t

The new federal tax on Global Intangible Low-Taxed Income (GILTI) is something of a misnomer: it’s certainly global and it’s definitely income, but the rest of it is, at best, an approximation. It’s not exclusively levied on low-taxed income, nor just on the economic returns from intangible property. So what is GILTI, why might states tax it, and what’s the problem with that?

8 min readToward a State of Conformity: State Tax Codes a Year After Federal Tax Reform

States incorporate provisions of the federal tax code into their own codes in varying degrees, meaning that federal tax reform has implications for state revenue beyond any broader economic effects of tax reform.

73 min read