All Related Articles

Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications

In our new report, we explore the design implications of a carbon tax and provide estimates for revenue, economic, and distributional effects of three potential carbon tax and revenue recycling proposals. Each proposal faces different trade-offs and achieves different policy goals.

23 min read

Results of 2019 State and Local Tax Ballot Initiatives

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read

Reviewing Elizabeth Warren’s Tax Proposals to Fund Medicare for All

Elizabeth Warren released a detailed plan on how she would fund Medicare For All, proposing a wealth tax, financial transactions tax, mark-to-market taxation of capital gains income, and a country-by-county minimum tax, among other reforms.

5 min read

The ABCs of the OECD Secretariat’s Unified Approach on Pillar 1

If there is double taxation due to digital services taxes or because a country is unwilling to conform to the structure of the Secretariat’s proposal, the impact would be a net negative for many businesses.

8 min read

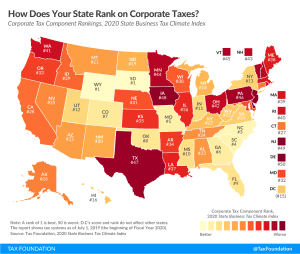

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read

UK Taxes: Potential for Growth

3 min read