All Related Articles

New Details on the Austrian Tax Reform Plan

14 min read

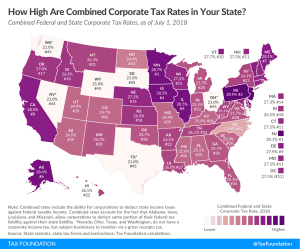

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

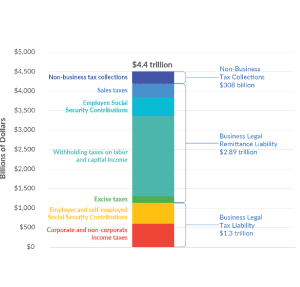

U.S. Businesses Pay or Remit 93 Percent of All Taxes Collected in America

Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

5 min read

Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read

The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

One of the most significant provisions in the Tax Cuts and Jobs Act was the reduction of the U.S. corporate income tax rate from 35 percent to 21 percent. Over time, the lower corporate rate will encourage new investment and lead to additional economic growth. It will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions.

2 min read

Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries

The U.S. decision to adopt a territorial tax system is certainly an improvement over having a worldwide system. However, in moving to a territorial system some of the new features created with the TCJA increased the complexity of the system.

38 min read

2017 GDP and Employment by Industry

In the U.S. economy, there are tens of millions of businesses, including more than 30 million pass-through businesses and more than a million C corporations. Most output and employment come from firms that provide services to consumers—such as education, health care, and social assistance services—though a large share of output and employment still comes from firms in production industries, particularly manufacturing.

2 min read

New Study Finds that High Tax Rates Lower the Chance of Business Survival

America’s tax code distorts the economic decision-making of firms, such as the favorable treatment of debt financing over equity. This study adds to this argument while providing motivation for policymakers to focus on how reforms to tax policy can increase American entrepreneurship.

2 min read

Iowa Adopts a “Soft” Property Tax Cap

3 min read

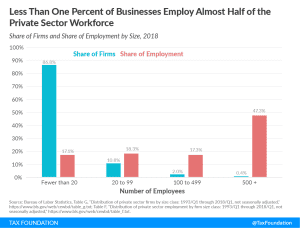

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

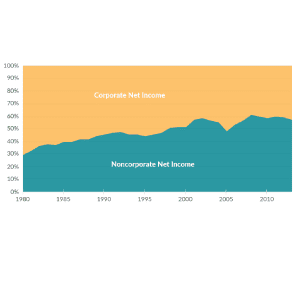

Corporate and Pass-through Business Income and Returns Since 1980

More business income is reported on individual tax returns than corporate returns. The U.S. now has fewer corporations and more individually owned businesses. Corporations make up less than 5 percent of businesses but earn 60 percent of revenues.

3 min read

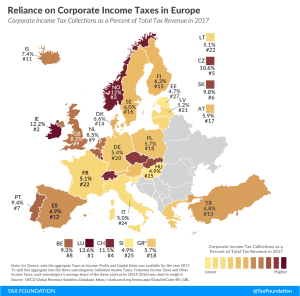

Sources of Government Revenue in the OECD, 2019 Update

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read