All Related Articles

Kentucky Legislature Overrides Governor’s Veto to Pass Tax Reform Package

By broadening bases while lowering rates, policymakers in Kentucky took a responsible approach to comprehensive tax reform.

2 min read

Modeling the Impact of President Trump’s Proposed Tariffs

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min read

Will Illinois Double Down on High Taxes?

Amending the Illinois constitution and adopting a graduated-rate income tax cannot solve the state’s fundamental problems. Instead, it doubles down on an already uncompetitive tax code.

16 min read

Lawmakers May Vote on Making Key Provisions of the TCJA Permanent

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

Gross Receipts Taxes in the Marijuana Industry Found to Cause Distortionary Effects

States considering legalizing and taxing marijuana should pay attention to natural experiments occurring in states across the country.

4 min read

Governor Dayton’s Budget Proposal: Some Pro-Growth Provisions, but Misses the Mark on Others

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

Facts and Figures 2018: How Does Your State Compare?

Facts and Figures is a one-stop data resource comparing the 50 states on over 40 measures of individual and corporate income taxes, sales taxes, excise taxes, property taxes, business tax climates, and more.

1 min read

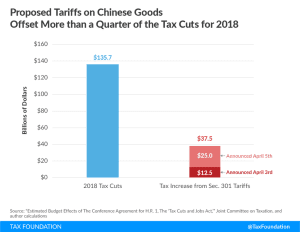

Proposed Chinese Tariffs Will Raise Taxes Following a Large Tax Cut

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read

How an Unexpected Revenue Ruling Penalizes Capital Investment in Pennsylvania, and How Lawmakers Can Fix It

Failure to reverse this newly adverse treatment of capital investment makes it less likely that businesses will invest in Pennsylvania.

15 min read