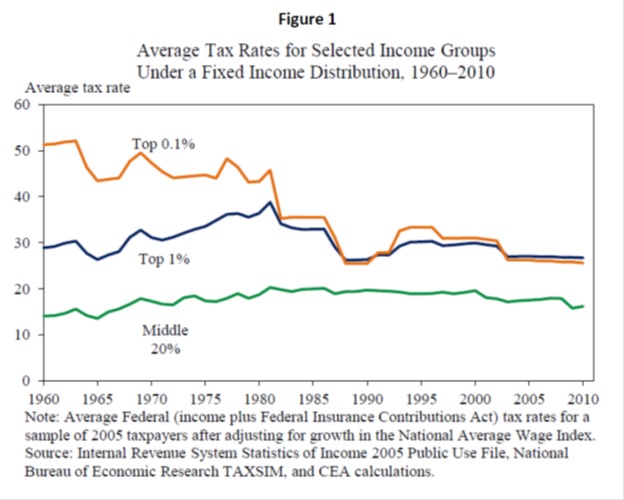

Scott Hodge recently commented on how the White House has used the chart below to bolster their claims that high-income earners pay too little taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , when in fact it indicates the top 1 percent pay about twice what middle-income households pay.

But this data only goes through 2010, and the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. holiday that’s been in place ever since means middle-income households pay even less – about 2 percentage points less. So the middle class pays not 14 percent, as the White House claims, but 12 percent, counting both payroll and individual income taxes. That’s lower than at any time since 1960.

The payroll tax holiday barely affects the average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of high-income earners since social security payroll taxes apply only to wages, not investment income, of up to $110,100 this year and $106,800 last year. That means high-income earners continue to pay about the same as they did in 2010 – around 26 percent – which is more than twice the rate that middle income households pay. It is likely even higher, since high-income earners derive much of their income from investments and business profits, which are both up since 2010.

Follow William McBride on Twitter @EconoWill

Share this article