Last week, the Tax Incentive Evaluation Committee, a group of Nebraskan legislators, convened to define both the goals of the state’s existing business taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. incentive programs and to create a process to evaluate the programs. The committee, chaired by Senator John Harms, was originally formed to address the vague nature of the tax incentive programs’ goals. Many Nebraskan legislators believe the tax incentive programs in place are crucial for the state to attract and maintain business investment and jobs in a competitive national environment.

However, as the Performance AuditA tax audit is when the Internal Revenue Service (IRS) conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. Committee admits in a report released last winter, gauging the success of the tax incentives is next to impossible without clear goals and evaluation standards. Robert Zahradnik, representing the Pew Center on the States, proposed suggestions to the committee for creating and implementing these standards. These suggestions include designing a periodic evaluation, collecting and accessing data, identifying metrics, and measuring economic impact.

While Nebraska certainly should adopt standards of accountability like these, such evaluation fosters a parochial view of tax policy. Although increases in business investment, employment, GDP, and per capita income due to tax incentives may be quantified, these metrics do not consider alternate scenarios. As Pew points out, it is important to approach metrics realizing that we do not know what businesses would have done in the absence of incentives, that spending on tax incentives means less spending elsewhere, and that incentives may hurt other non-incentivized businesses.

The question Nebraska should therefore be asking is: is there a better way to achieve the goals of the tax incentive programs of increasing small business support, investment, quality jobs, and retention of graduates and businesses as well as helping economically depressed rural areas?

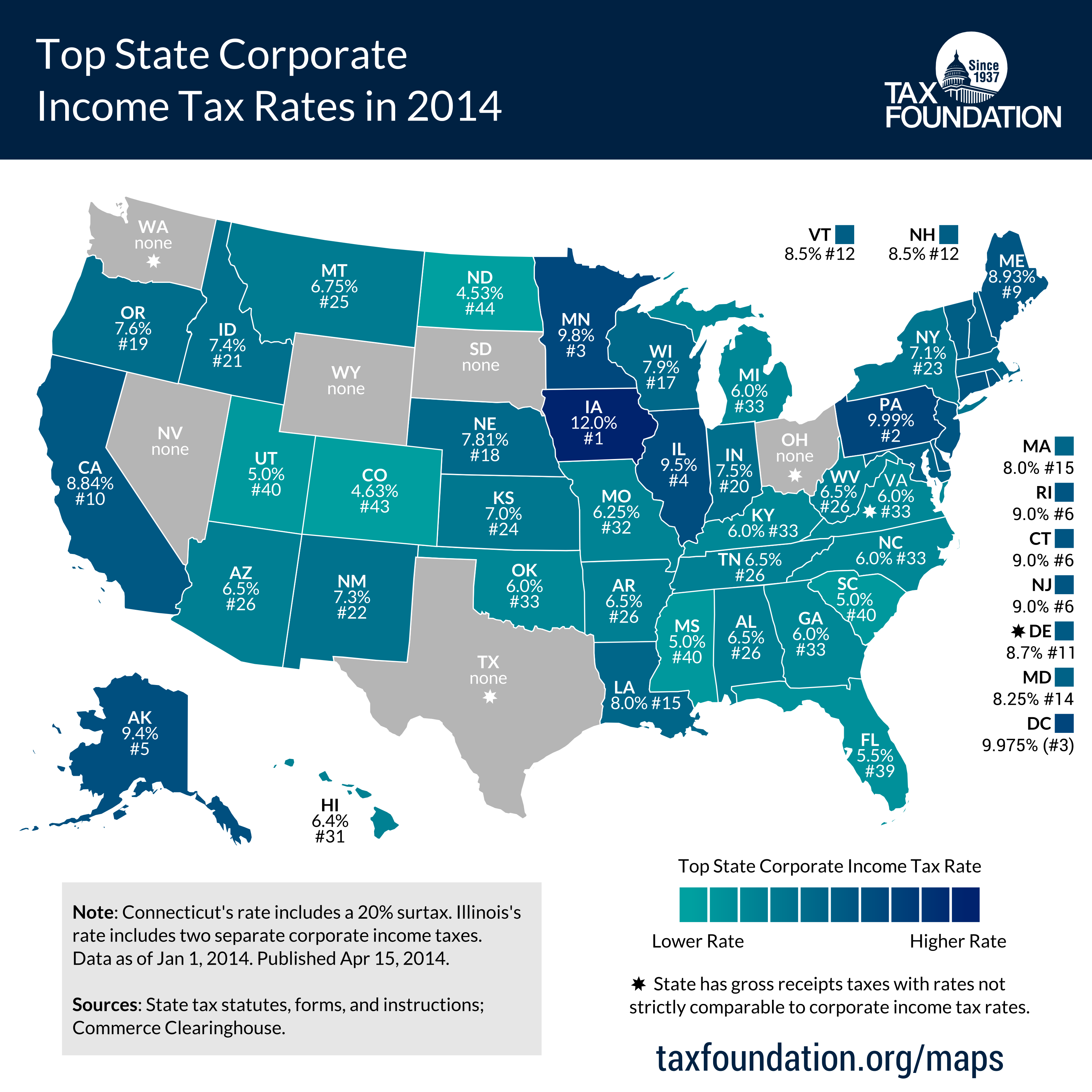

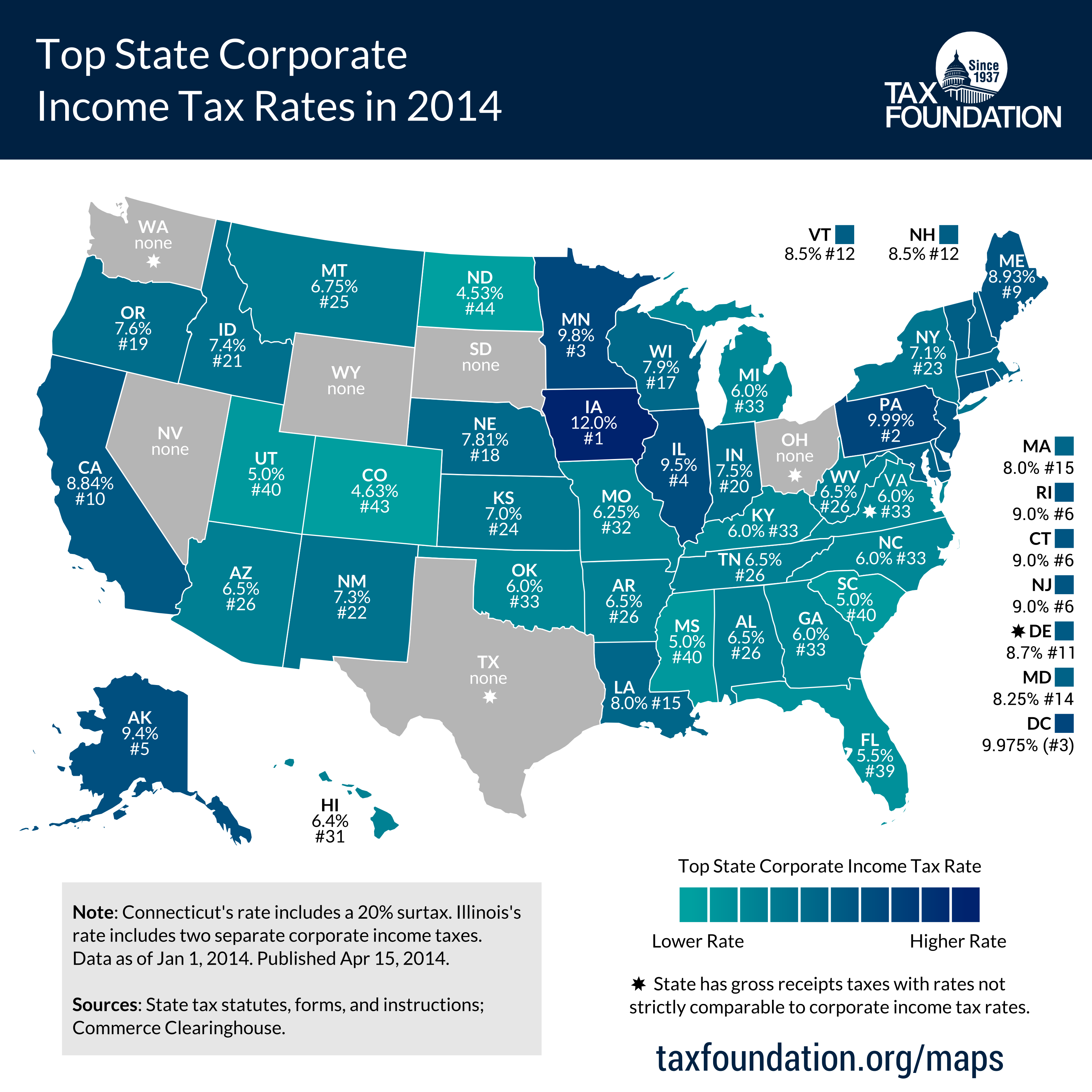

The answer is yes, and the alternative is to broaden the corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. by eliminating these credits and use the increased revenue to lower the state’s 7.81 percent top corporate tax rate, the 18th highest in the nation (see map below). Doing so would benefit Nebraska by increasing the state’s competitiveness, and is an option that should be seriously considered in the 2015 legislative session, as part of a larger tax reform to reduce income tax rates among other improvements.

As things are now, the tax incentives only serve to pick winners and losers, distort business incentives and decisions, and provide short-lived employment benefits.

In fact, four of the six main business tax incentives in Nebraska have stated goals of encouraging selective industries. This is not only unfair to non-incentivized business, but it also causes capital and labor to be diverted from their most productive uses. Why should a software development company situate in Omaha when it takes up land that would have otherwise been used for the expansion of a food processing facility? Why should a farm modernize its livestock facilities when its baler is in disrepair?

Holding Nebraska’s tax incentive programs accountable to specific goals and benchmarks is indeed a necessary step in promoting transparency and efficacy of the tax system, but the Tax Incentive Evaluation Committee should instead look to evaluate the actual need for the current tax incentives.

More on Nebraska here.

Share