All Related Articles

Putting the Pieces Together on BEPS

Taxes matter for decisions to be made by businesses, individuals, and families, and it is important for policymakers to understand that rules can be designed to be neutral rather than distortionary.

6 min read

Switzerland Referendum Approves Tax Reform

15 min read

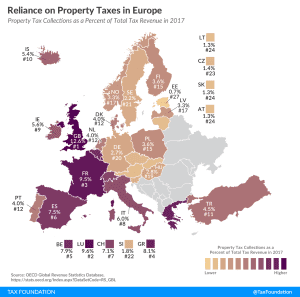

Reliance on Property Taxes in Europe

1 min read

Measuring Opportunity Zone Success

16 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

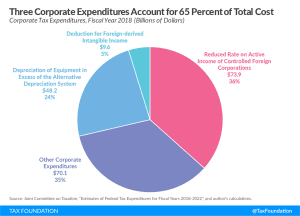

Not All Tax Expenditures Are Equal

The debate in Washington, D.C. often centers around tax expenditures, so-called corporate loopholes, in the tax code. But not all tax expenditures are created equal. Some represent neutral tax treatment and should be left alone, while others are distortionary and should be repealed. Understanding what a tax expenditure represents is essential for understanding how our tax code works for both businesses and individuals.

4 min read

Tax Burden on Labor in Europe, 2019

2 min read

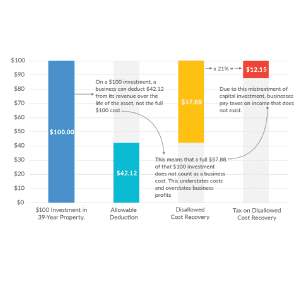

Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

While tax rates matter to businesses, so too does the measure of income to which those tax rates apply. The corporate income tax is a tax on profits, normally defined as revenue minus costs. However, under the current tax code, businesses are unable to deduct the full cost of certain expenses—their capital investments—meaning the tax code is not neutral and actually increases the cost of investment.

3 min read

Taxes on Capital Income Are More Than Just the Corporate Income Tax

The United States’ statutory corporate income tax rate is now more aligned with the rates of other nations . However, taxes on capital income, or corporate investment, are more than just the corporate income tax. Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

3 min read

Reliance on Consumption Taxes in Europe

2 min read

The Tax Gap Tops $500 Billion a Year

4 min read

New Details on the Austrian Tax Reform Plan

14 min read

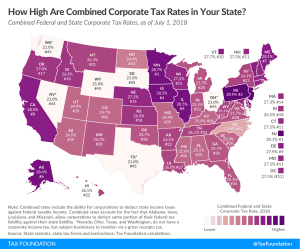

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

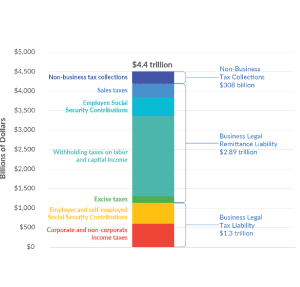

U.S. Businesses Pay or Remit 93 Percent of All Taxes Collected in America

Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

5 min read