Spanish Taxpayers to Be Hit by Two Major Taxes in 2021

Spain’s upper house passed two major tax bills today: the financial transaction tax (FTT) and the digital service tax (DST). Both taxes will go into effect in January 2021.

3 min read

Spain’s upper house passed two major tax bills today: the financial transaction tax (FTT) and the digital service tax (DST). Both taxes will go into effect in January 2021.

3 min read

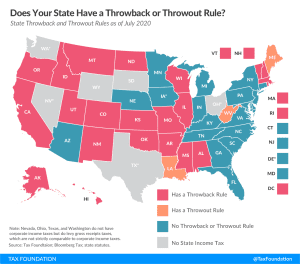

State throwback and throwout rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states which impose such rules.

3 min read

Heading into Election Day, the Illinois legislature and Governor J.B. Pritzker (D) are trying to convince voters to scrap a key constitutional feature of Illinois’ tax system: a provision in the state constitution that prohibits a graduated-rate income tax.

18 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

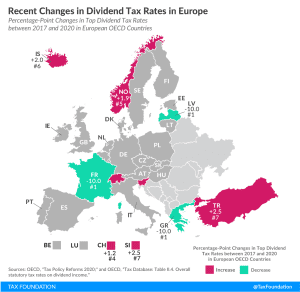

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read

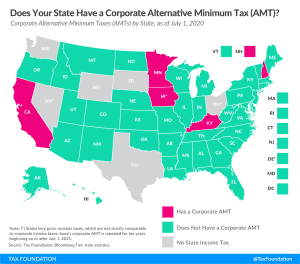

Five states currently collect corporate AMTs: California, Iowa, Kentucky, Minnesota, and New Hampshire. This is a significant drop from the eight states that levied AMTs in tax year 2017.

2 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

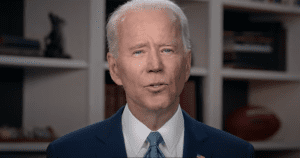

Depending on the outcome of the 2020 presidential election, we could be looking at a very different tax code in the years to come. What tax changes has former Vice President Joe Biden proposed and what would they mean for U.S. taxpayers, businesses, and the overall economy?

On Election Day this year, California voters will vote on Proposition 15, a ballot measure that would create a “split roll” property tax system in the Golden State, increasing taxes on just commercial property by $8 billion to $12.5 billion.

15 min read

The design and implementation of a global minimum tax is not simple and straightforward. There are dozens of challenging issues that policymakers will need to consider. So, when it comes to the way the minimum tax treats new investment, it seems clear that incorporating full expensing into the design would have significant benefits.

6 min read

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

The pandemic precipitated the steepest decline in economic output and employment in recent history, which is leading to a drop in tax revenue. At the same time, the federal response to the crisis is producing a large increase in spending. This combination will cause the federal budget deficit to spike.

5 min read

The House Republican Study Committee released a proposal, “Reclaiming the American Dream,” which includes 118 policy recommendations to address education, labor, and welfare policy with the aim of expanding opportunity, liberty, and free enterprise for all Americans.

7 min read

Joe Biden recently released a piece reviewing his tax proposals, contrasting them with President Donald Trump’s tax ideas. A major theme within this piece can be summarized in the title: “A Tale of Two Tax Policies: Trump Rewards Wealth, Biden Rewards Work.”

4 min read

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

A recent OECD report reveals a tendency towards higher property taxes, often in the form of base broadening, tax rate increases, or both.

5 min read

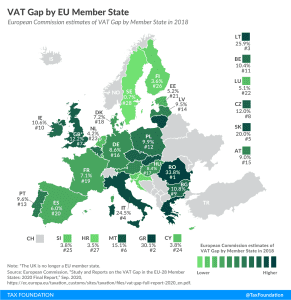

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

What does the Senate Republican coronavirus package do? Are there better ways of providing short-run relief without making the tax code more complicated?

6 min read

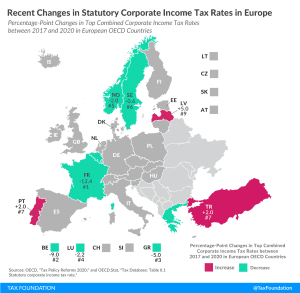

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read