Gross Receipt Taxes Become Part of New Jersey’s Recreational Marijuana Legalization

By the time marijuana is sold to a consumer, local taxes could be applied four different times—by one or more localities.

5 min read

By the time marijuana is sold to a consumer, local taxes could be applied four different times—by one or more localities.

5 min read

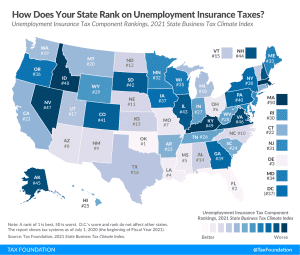

With 2020 nearing its close, state unemployment compensation trust funds continue to struggle under the weight of so many pandemic-created beneficiaries, though some funds are beginning to stabilize as people increasingly return to work.

3 min read

Combined state and local tax collections were down only $7.6 billion across the period, representing a total state and local tax revenue decline of 0.7 percent compared to the first nine months of 2019.

6 min read

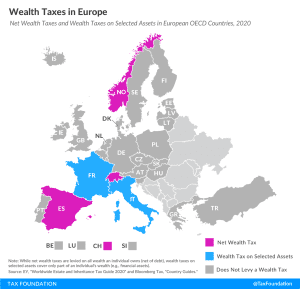

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

A bipartisan group of lawmakers released two compromise relief bills to address the COVID-19 pandemic, totaling about $908 billion: The Emergency Coronavirus Relief Act and the Bipartisan State and Local Support and Small Business Protection Act.

4 min read

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

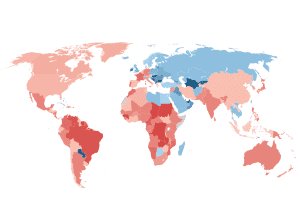

What is driving the downward trend in corporate tax rates and will it continue? Is it truly a race to the bottom? Why do corporate tax rates matter in the first place? How does the U.S. rate compare and could that change in the coming years?

The Regional Tax Competitiveness Index (RTCI) for Spain allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare. This Index has been designed to analyze how well regions structure their tax system. Additionally, it serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

Any additional relief to address a temporary economic crisis should be temporary, targeted toward those most in need, and consistent with good long-term tax policy.

3 min read

Corporate tax rates have been declining in every region around the world over the past four decades as countries have recognized their negative impact on business investment. Our new report explores the latest corporate tax trends and compares corporate tax rates by country.

22 min read

Just in time for the holidays, one lawmaker wants to tax New York City residents $3 for every package they order online, excluding food and medicine

3 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

Policymakers should consider finding ways to simplify the administration of relief during future crises. This will help ensure the relief is timely and targeted, key components of any successful relief package for this crisis or crises in the future.

3 min read

With days left until government funding runs out, congressional lawmakers are down to the wire to fund the government and provide additional pandemic-related relief to the households and businesses trying to make it through the winter.

3 min read

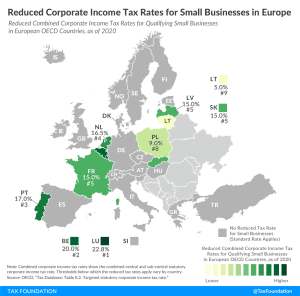

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses

2 min read

It’s important for Poland to understand the main lesson of the Estonian approach: taxes should be designed with an overarching approach to maximize neutrality and minimize complexity and distortions. Instead of simply adopting a preference for small businesses, the Polish government should instead overhaul its corporate tax rules and truly adopt the Estonian approach to taxation.

2 min read

A bipartisan coalition of Senators unveiled a $908 billion COVID-19 relief bill on Tuesday, which includes, among other provisions, $160 billion in additional aid to state and local governments. It is worth briefly exploring what this would mean, and the amounts of aid your state might expect.

5 min read

While a sweeping tax policy bill is unlikely in the near future, lawmakers may be able to come together on a smaller scale. Pairing better cost recovery on a permanent basis with support for vulnerable households as well as additional pandemic-related relief would help promote a more rapid return to growth and help businesses and households weather the ongoing crisis.

4 min read