Costly Inputs: Unraveling Sales Tax’s Impact on Businesses

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

The CBO projects deficits will be higher than historical levels, largely due to growth in mandatory spending programs While some recent legislation has reduced the deficit, the Inflation Reduction Act is proving to be more expensive than originally promised.

5 min read

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Limiting interest deductibility continues to be a worthwhile policy goal, but given the current climate, policymakers should opt to pair any further limitations with other pro-growth policies such as full expensing to ensure firms’ incentives to invest are preserved.

3 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

We’re exploring the intricacies of the latest congressional act stirring up Washington—The Tax Relief for American Families and Workers Act of 2024.

Credit unions’ privileged status as tax-exempt nonprofit organizations may have filled a market need during the Great Depression, but 90 years later, there is no longer a justification to subsidize these institutions.

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The Trump campaign is mulling a massive tax increase on American purchases from China. If reelected, he might quintuple the tax, imposing tariffs of 60 percent on imports from China. The economic ramifications would be significant and unwelcome.

5 min read

Examining the revenue, economic, and distributional effects of a hypothetical deal with permanent tax policy changes shows the longer-run trade-offs policymakers would face.

5 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

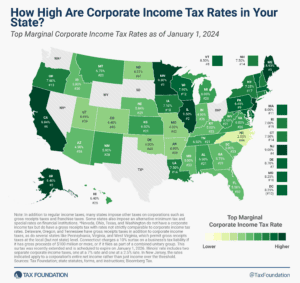

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

7 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

Lawmakers should prioritize creating a tax system that supports investment more broadly rather than subsidizing specific industries and allowing broad, neutral pro-investment provisions to expire.

3 min read