All Related Articles

U.S. Tax Incentives Could be Caught in the Global Minimum Tax Crossfire

The current prospect for the global minimum tax requires the attention of U.S. lawmakers. Otherwise, a tax benefit at home will just mean a tax increase abroad.

6 min read

What the U.S. Can Learn from the Adoption (and Repeal) of Wealth Taxes in the OECD

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read

What Do Global Minimum Tax Rules Mean for Corporate Tax Policies?

The new OECD global minimum tax rules are complex, and some countries may opt to put them in place on top of preexisting rules for taxing multinational companies. However, countries should also consider ways to reform their existing rules in response to the minimum tax.

7 min read

How Heavily Taxed Are U.S. Multinationals?

In general, the effective tax rates on the foreign profits of U.S. multinationals are not that low relative to the U.S. tax rate, contrary to popular rhetoric.

7 min read

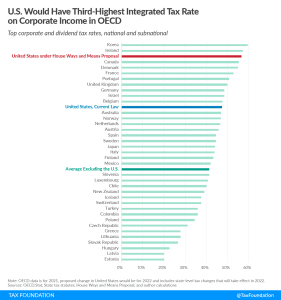

U.S. Corporate Income Faces Third-Highest Integrated Tax Rate in OECD Under Ways and Means Plan

Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

3 min read

Choose Your Own Adventure: Global Minimum Tax Edition

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have surfaced in recent weeks, there are clear divides among various proposals.

5 min read

Expense Allocation: A Hidden Tax on Domestic Activities and Foreign Profits

While arcane, expense allocation rules are relevant to current debates because they result in a heavier tax burden for U.S. companies under current law than the recently negotiated global minimum tax proposal.

10 min read

International Tax Proposals and Profit Shifting

There are many ways the U.S.’s international tax rules could be changed, reformed, improved, or worsened. Reflexively jacking up taxes on U.S. multinationals does not necessarily accomplish the goal of reducing or eliminating profit shifting, and it would in fact worsen it.

6 min read

Adoption of Global Minimum Tax Could Raise U.S. Revenue…or Not

This interaction between the U.S. proposals and those that may be put into law in foreign jurisdictions should give lawmakers caution when evaluating the revenue potential of changes to GILTI.

7 min read

Four Revenue Scores on Options to Change U.S. International Tax Rules

Changes to international tax rules are likely on the way, and it is therefore important for lawmakers to understand how various reform options would impact U.S. tax burdens on multinational companies. Moreover, policymakers should also recognize the need for prudent policies that do not put U.S.-based multinationals at a competitive disadvantage or severely curtail investment and hiring.

9 min read

Options for Reforming the Taxation of U.S. Multinationals

The Biden administration’s international tax proposals would impose a 7.7 percent surtax on the foreign profits of U.S. multinationals, resulting in a net increase in profit shifting out of the U.S.

60 min read

Survey Shows Growing Tax Complexity for Multinationals

New data clearly points to an increase in tax complexity for multinationals in the OECD as well as globally. The OECD’s ongoing efforts to reform the international tax system will likely further add complexity to the international tax environment.

3 min read

Insights from the UN World Investment Report for Global Tax Reform

The United Nations (UN) recently released its annual “World Investment Report,” which shows the dramatic fall in global foreign direct investment (FDI) caused by the COVID-19 crisis.

3 min read

Biden’s Top Marginal Capital Gains Tax Rate Would Be Highest in OECD

President Biden’s proposal to tax capital gains at higher, ordinary income tax rates would lead the U.S. to have the highest top marginal tax rate on capital gains in the OECD.

2 min read

U.S. Corporate Tax Expenditures and Effective Tax Rates in Line with OECD Peers

Last week, an analysis by Reuters suggested that U.S. firms pay less income tax than foreign competitors, in part because “the U.S. tax code is unusually generous with tax breaks and deductions,” also known as corporate tax expenditures. However, the Reuters analysis is at odds with other data and studies indicating that U.S. corporate tax expenditures and effective tax rates are about on par with those in peer countries in the OECD.

3 min read

A Global Minimum Tax and Cross-Border Investment: Risks & Solutions

Leaders around the world are quickly moving to finalize an agreement on a global minimum tax in 2021, based on the so-called “Pillar Two” proposal from the OECD.

25 min read

G7 Agrees to Global Minimum Tax

One of the hottest topics in the tax world today is the recent announcement by G7 finance ministers that they would support enacting a new, 15-percent global minimum tax. We dive into the economic and political implications and how such a tax would impact global economies, revenues, and real people.

Carve-ins and Carve-outs: Open Questions for Global Tax Reform

There has been some confusion about how some parts of the recent G7 agreement on new tax rules for multinational companies might work. The new policies would target the largest and most profitable multinationals and bring in a global minimum tax.

5 min read

Countries Should Be Cautious about Relying on Inheritance Taxes for Revenue

As tempting as inheritance, estate, and gift taxes might look especially when the OECD notes them as a way to reduce wealth inequality, their limited capacity to collect revenue and their negative impact on entrepreneurial activity, savings, and work should make policymakers consider their repeal instead of boosting them.

5 min read