Three Questions on Pillar One

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min read

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min read

Academic research indicates foreign direct investment (FDI) is highly responsive to the corporate effective tax rate (ETRs); that is, the tax rate after accounting for all deduction and credits available to corporations.

3 min read

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

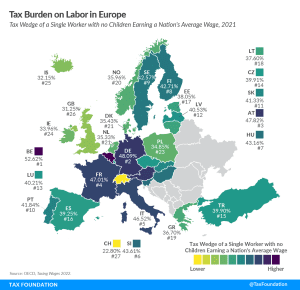

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

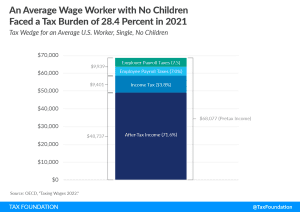

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay nearly 30 percent of their wages in taxes.

4 min read

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

Treasury Secretary Janet Yellen offered estimates from the EU Tax Observatory as evidence that the Polish government would benefit from supporting the global tax deal. Unfortunately, evidence was, at best, out of date.

2 min read

The ongoing economic uncertainty from the COVID-19 pandemic, supply chain disruptions, and current inflationary pressures have highlighted the importance of investment.

33 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

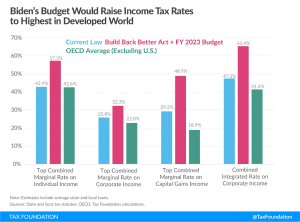

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

In recent years, EU countries have undertaken a series of tax reforms designed to maintain tax revenue levels while supporting investment and economic growth. However, not all tax reforms were created equal.

7 min read

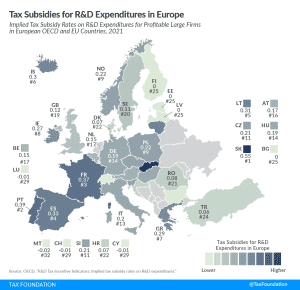

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

3 min read

Double taxation impacts the ability of companies to invest valuable things like improving their supply chains, developing new products, and hiring workers, and it can be fixed if the minimum tax uses a country’s own tax rate.

8 min read

While much of the policy focus has been on proposals embedded in the Build Back Better agenda, a meaningful tax hike for multinational companies has already been adopted.

1 min read

Complex tax policies that work well “in theory” can often have a hard time when the rubber meets the road. One instance of this is the challenge that the OECD has created for itself with the global tax deal, also fondly known as Pillar 1 and Pillar 2.

7 min read