All Related Articles

Summary and Analysis of the OECD’s Work Program for BEPS 2.0

From a broad standpoint, agreement at the OECD will require countries to give up some measure of their own tax sovereignty on policies they have designed to minimize the distortionary effects of the corporate income tax. Over the years tax competition has led to some countries adopting policies that are attractive to businesses because they have a more neutral rather than distortionary approach to taxing corporate income. This project could directly undermine that progress by introducing new levels of complexity and distortion that would ultimately have a negative impact on global trade and growth.

34 min read

Italy Can Pay for a Flat Tax

4 min read

Corporate Tax Rates Around the World, 2018

Since 1980, the worldwide average statutory corporate tax rate has consistently decreased as countries have realized the negative impact that corporate taxes have on business investment decisions.

11 min read

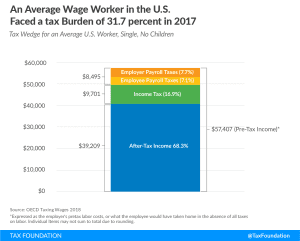

A Comparison of the Tax Burden on Labor in the OECD, 2018

Before accounting for state and local sales taxes, the tax burden that a single average wage earner faces in the U.S. is 31.7 percent of pretax earnings, amounting to $18,198 in taxes in 2017.

18 min read

The OECD Highlights the Economic Growth Benefits of Full Expensing

The Organisation for Economic Co-operation and Development (OECD) praised a measure in the Tax Cuts and Jobs Act (TCJA) passed last December.

2 min read

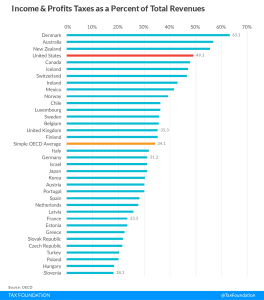

Contrary to “Fair Share” Claims, Businesses are Central to Tax Collection Systems

Taxes matter to investment decisions. Global tax collectors must weigh the marginal benefit of additional revenues against the economic harm high business taxes could cause.

19 min read

A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act moved the U.S. toward more of a territorial corporate tax system used by most other OECD countries. However, the U.S. law contains key differences in the treatment of foreign profits.

24 min read

Corporate Income Tax Rates around the World, 2017

The last time the U.S. reduced its federal corporate income tax rate was in 1986. Since then, countries throughout the world have significantly reduced their rates, leaving the U.S. with the fourth highest statutory corporate tax rate in the world and an overall uncompetitive tax system.

11 min read

Designing a Territorial Tax System: A Review of OECD Systems

A well-designed territorial tax system would reduce the incentive for companies to invert, encourage businesses to invest in and expand operations throughout the world, and allow capital to flow more freely back to the U.S., but would also come with some new challenges.

28 min read