All Related Articles

UK Pledges Corporate Rate Reduction

1 min read

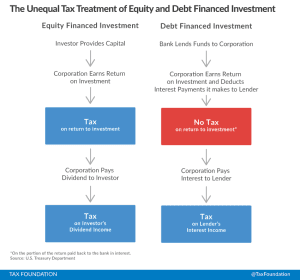

Details and Analysis of the 2016 House Republican Tax Reform Plan

According to the Tax Foundation’s Taxes and Growth Model, the plan would significantly reduce marginal tax rates and the cost of capital, which would lead to 9.1 percent higher GDP over the long term, 7.7 percent higher wages, and an additional 1.7 million full-time equivalent jobs.

15 min read

Details of the House GOP Tax Plan

2 min readExpensing Drama

2 min read

The Compliance Costs of IRS Regulations

8 min readPuerto Rico Needs a Growth Agenda Too

7 min readA New Menu of Options for Tax Reform

3 min read