All Related Articles

Biden’s Proposed Capital Gains Tax Rate Would be Highest for Many in a Century

The Biden administration is proposing to tax long-term capital gains at ordinary income rates for high earners, which will bring the top federal rate to highs not seen since the 1920s.

2 min read

Excluding GILTI and Reducing the Corporate Tax Rate Would Improve Nebraska’s Economic Competitiveness

Excluding Global Intangible Low-Taxed Income (GILTI) from taxation and reducing the state’s top marginal corporate rate would improve the state’s economic competitiveness and are among the top income tax modernization priorities Nebraska policymakers ought to consider.

4 min read

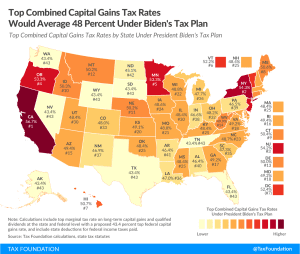

Top Combined Capital Gains Tax Rates Would Average 48 Percent Under Biden’s Tax Plan

The top federal rate on capital gains would be 43.4 percent under Biden’s tax plan (when including the net investment income tax). Rates would be even higher in many U.S. states due to state and local capital gains taxes, leading to a combined average rate of over 48 percent compared to about 29 percent under current law.

3 min read

Comparing the Trade-offs of Carbon Taxes and Corporate Income Taxes

President Biden’s choice to fund new spending programs with increased corporate taxes comes with trade-offs for American output and incomes.

3 min read

Corporate Investment Outweighs Federal Revenue Losses Since TCJA

The Biden administration has argued for raising the corporate tax rate to offset the drop in federal corporate revenues following the Tax Cuts and Jobs Act (TCJA) of 2017, claiming it did not lead to more corporate investment as advertised. Although corporate revenues did drop following this tax reform, the ensuing increase in corporate investment far exceeds these revenue losses.

1 min read

Modernizing Rental Car and Peer-to-Peer Car Sharing Taxes for a Post-Pandemic Future

The economic evidence shows that travelers and tourists are sensitive to price changes for rental cars and adjust their behavior to avoid the tax, harming state economies and the travel sector right as the industry is trying to recover from the effects of the coronavirus pandemic.

30 min read

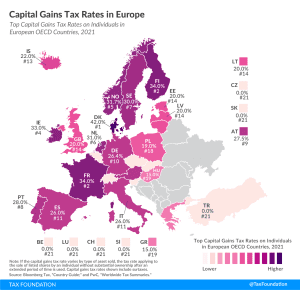

Capital Gains Tax Rates in Europe, 2021

4 min read

Raising the Corporate Rate to 28 Percent Reduces GDP by $720 Billion Over Ten Years

The Options guide presents the economic effects we estimate would occur in the long term, or 20 to 30 years from now, but we can also use our model to show the cumulative effects of the policy change—providing more context, for instance, about how the effects of a higher corporate income tax rate compound over time, which we estimate would reduce GDP by a cumulative $720 billion over the next 10 years.

4 min read

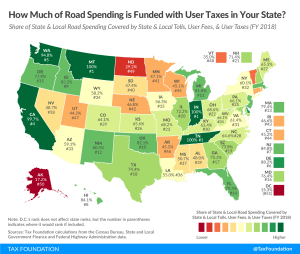

Road Taxes and Funding by State, 2021

Traditionally, revenue dedicated to infrastructure spending has been raised through taxes on motor fuel, license fees, and tolls, but revenue from motor fuel has proven less effective over the last few decades.

6 min read

More Tax Hikes Than Investment Projects?

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

New Research Finds Limited Effects on Taxpayer Behavior from Pass-through Deduction

While proponents of the Section 199A pass-through deduction claimed it would boost investment and critics claimed it would encourage tax avoidance and income shifting, new research casts doubt on both claims.

3 min read

Imposing New Taxes on Peer-to-Peer Car Sharing Will Not Help Texas Economic Recovery

Imposing the rental car excise tax on peer-to-peer car sharing would be a move in the wrong direction by expanding a costly and distortive tax for visitors whose business will help Texans recover post-pandemic.

4 min read

Common Tax Questions, Answered

Get answers to some of the tax policy questions we hear most often from taxpayers, businesses, and journalists. Learn everything from the basics of who pays taxes and the difference between credits and deductions, to how taxes impact the economy and what constitutes sound tax policy. Discover additional resources to explore each question and topic in more depth.

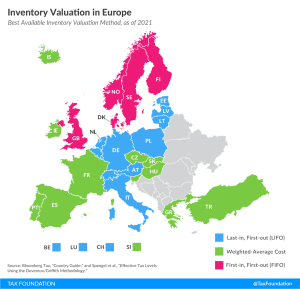

Inventory Valuation in Europe

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

Treasury’s Latest Pillar 1 Proposal: A Strategy to Split the Riches or Give Away the Store?

New international tax rules on super-profits would disproportionately impact U.S. companies however they are designed. The question that Treasury should answer is why limit the policy in such a way that magnifies that disproportionate application and the risk to the U.S. tax base.

6 min read

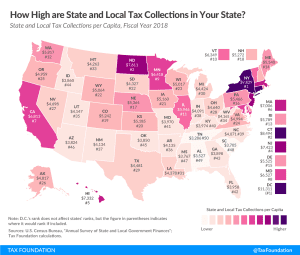

State and Local Tax Collections by State, 2021

Although Tax Day has been pushed back this year, mid-April is still a good occasion to take a look at tax collections in the United States. Because differing state populations can make overall comparisons difficult, today’s state tax map shows state and local tax collections per capita in each of the 50 states and the District of Columbia.

3 min read

Reviewing the Federal Tax Treatment of Research & Development Expenses

Simplifying the R&D credit, making it more accessible for smaller firms, and ensuring full cost recovery for R&D expenses by canceling the upcoming R&D amortization are three things policymakers should consider when trying to improve the tax code for R&D.

40 min read

Biden’s Corporate Minimum Book Tax Narrows, but Problems and Uncertainties Remain

The corporate tax base should be reformed directly, rather than piecemeal through a complicated and burdensome separate tax applicable to a small number of companies.

5 min read

Denying Deductions for Pharma Ads Is Bad Tax Policy

The “End Taxpayer Subsidies for Drug Ads Act” would prohibit companies from deducting the costs of prescription drug advertisements directed at the public. However, the bill’s title is a misnomer: the deduction is not a tax subsidy.

2 min read