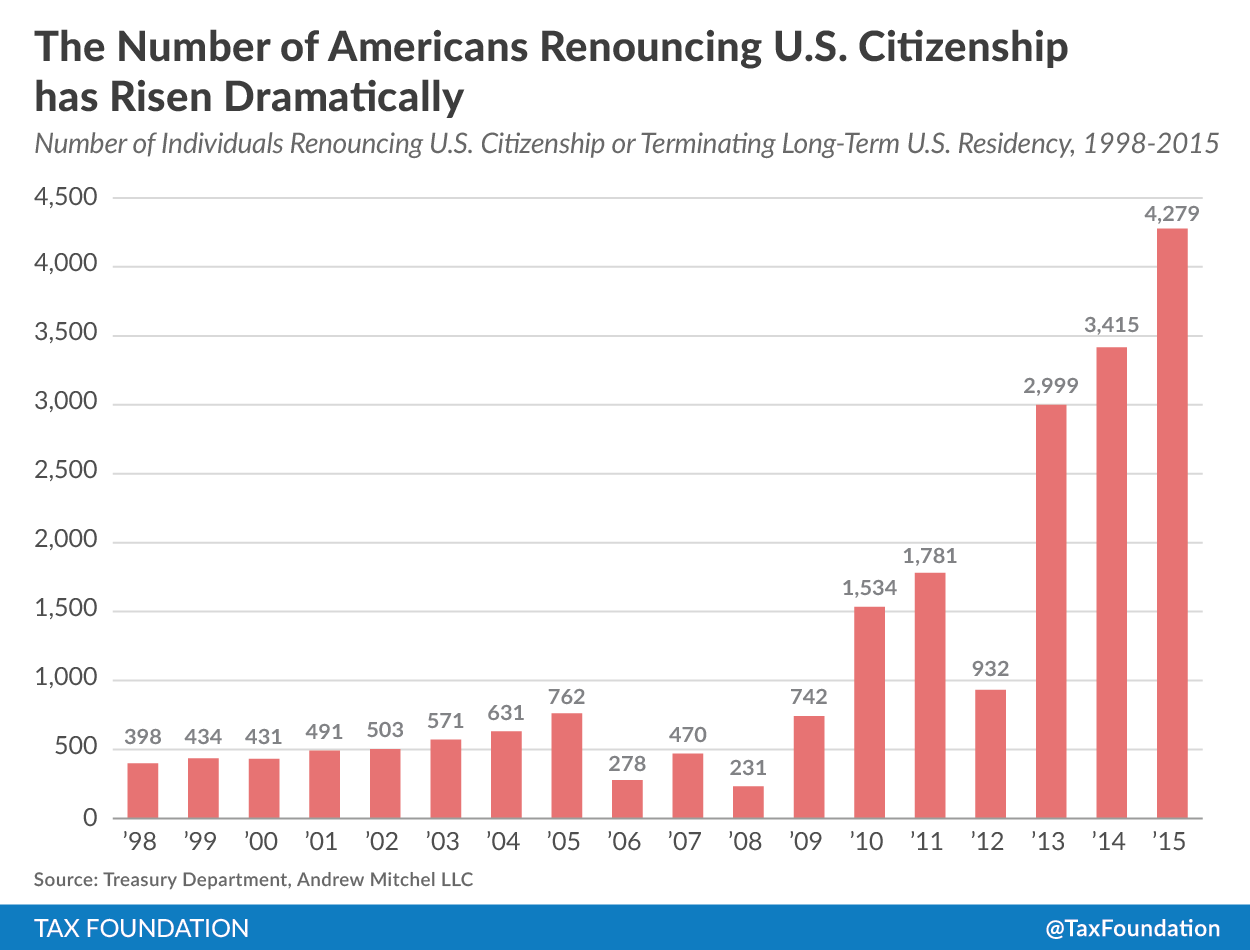

Last year, 4,279 individuals renounced their U.S. citizenship or terminated their long-term U.S. residency, according to the Treasury Department. This figure is up by 25.3 percent from 2014, when 3,415 individuals renounced their citizenship. All in all, 2015 was a record-setting year for expatriation: more Americans gave up their citizenship last year than in any other year in recent history.

Looking at expatriation statistics over the last two decades, it is clear that the latest data is part of a larger trend. Between 2013 and 2015, over 10,693 Americans have renounced their citizenship – more than the 10,189 that renounced their citizenship over the fifteen-year period between 1998 and 2012.

Many commenters have attributed the rise in Americans renouncing their citizenship to the Foreign Account TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Compliance Act (FATCA). Passed in 2010, FATCA introduced stringent reporting rules for foreign financial institutions that hold the assets of U.S. citizens, as well as for U.S. citizens that hold money in foreign accounts. FATCA also imposes large penalties on banks and individuals that do not comply with reporting requirements.

Although intended to combat tax avoidance, these new rules and penalties have also made life more difficult for Americans living overseas. Many foreign banks are now no longer willing to serve U.S. clients, and some overseas Americans have seen their financial accounts closed by foreign banks.

There’s a good case to be made that the introduction of FATCA led many Americans living overseas to renounce their citizenship. Consider the following:

- FATCA was passed in early 2010. In that year, the number of Americans that renounced their citizenship doubled, from 742 to 1,534.

- The final FATCA regulations were issued in early 2013. In that year, the number of Americans that renounced their citizenship tripled, from 932 to 2,999.

- FATCA’s penalties on banks went into effect in mid-2014. Since these penalties went into effect, 6,119 Americans have renounced their citizenship – more than the total number of Americans that renounced their citizenship during the entire first decade of the century.

Importantly, FATCA is one of many U.S. tax policies that make life difficult for Americans living overseas. The U.S. is one of only two countries in the world that taxes all income earned by its citizens, whether or not they live in their home country. This means that income earned by Americans living overseas is taxed twice – once by the foreign country in which they live, and once by the United States. The double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of Americans living overseas is often a central reason why Americans choose to renounce their citizenship.

Share this article