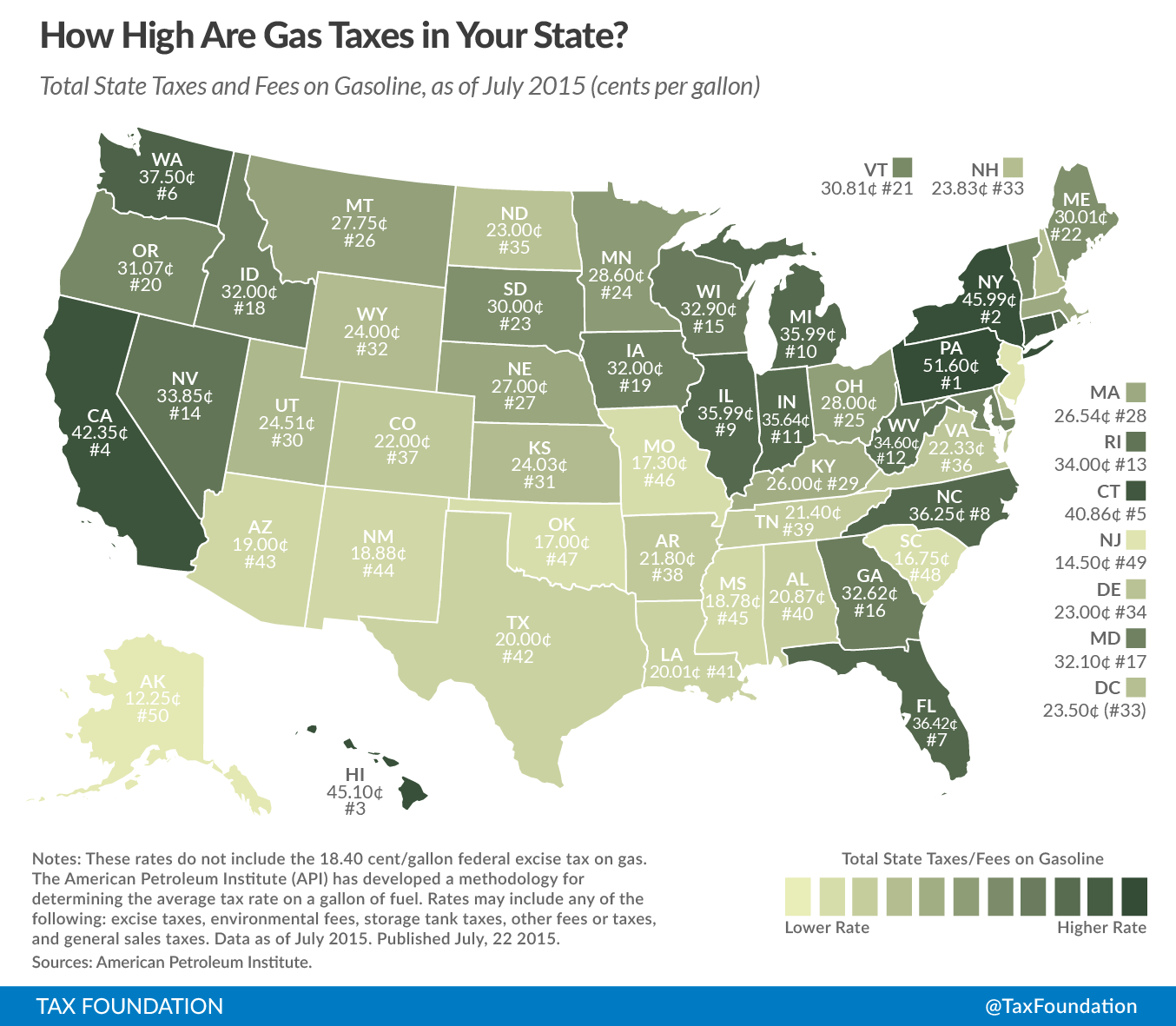

This week’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. map takes a look at state gasoline tax rates, using data from a recent report by the American Petroleum Institute. Pennsylvania has the highest rate of 51.60 cents per gallon (cpg), and is followed closely by New York (45.99 cpg), Hawaii (45.10 cpg), and California (42.35 cpg). On the other end of the spectrum, Alaska has the lowest rate at 12.25 cpg, but New Jersey (14.50 cpg) and South Carolina (16.75 cpg) aren’t far behind. These rates do not include the additional 18.40 cent federal excise tax.

(See our reposting policy here.)

Gas taxes are generally used to fund transportation infrastructure maintenance and new projects. While gas taxes are not a perfect user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. like tolls, they are generally more favorable than other taxes because they better connect the users of roads with the costs of enjoying them. However, many states’ and the Federal government’s gas taxes are not adjusted for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and therefore do not respond to price changes. Over time, a nominal gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. rate will decline in real terms, while the costs associated with funding roads will increase with inflation. This has been a contributing factor to the insolvency of the federal Highway Trust Fund, which runs out of funds at the end of this month.

States vary in how they impose gas taxes. Some impose a cents per gallon excise; others impose motor fuel-specific wholesale or retail sales taxes or “rack taxes” based on average prices over a given period; and many impose environmental cleanup and other miscellaneous taxes atop the traditional gas tax. API’s methodology converts these disparate tax structures into an estimate of gas taxes expressed in cents per gallon to facilitate comparisons across states.

Share this article