State Tax Ballot Measures to Watch on Election Day 2022

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

West Virginia Amendment 2 would not directly reduce tangible personal property taxes—on cars, inventory, or machinery and equipment. It would, however, empower the legislature to consider such reforms.

4 min read

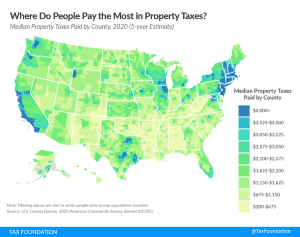

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

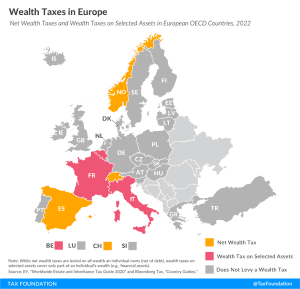

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min readDesigning tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

While there are many ways to show how much is collected in taxes by state governments, our State Business Tax Climate Index is designed to show how well states structure their tax systems and provides a road map for improvement.

169 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

The Index provides lessons for policymakers when they are thinking of ways to remove distortions from their tax systems and remain competitive against their peers. The further up a country moves on the Index, the more likely it is to have broader tax bases, relatively lower rates, and policies that are less distortionary to individual or business decisions. Going the other way reveals a policy preference for narrow tax bases, special tax policy tools, and rules that make it difficult for compliance.

5 min read

A well-structured tax code (that’s both competitive and neutral) is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

40 min read

States can enhance tax neutrality across industries by reforming tax structures that penalize certain business activity, leaning less on generous incentives, and focusing more on creating a tax code that provides for low and competitive burdens for all comers.

5 min read