Pro-Growth Tax Reform for Oklahoma, 2025

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

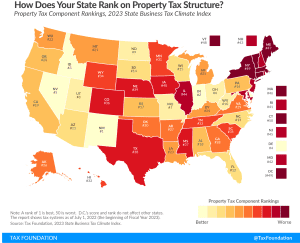

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

Gov. Pillen is searching for tax burden relief. But his plan, which reportedly involves a two-tiered sales tax and the state’s assumption of most school funding responsibility, would have profound implications that even those most convinced of the urgency of property tax relief may find unworkable and unpalatable.

12 min read

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

Does your state have a small business exemption for machinery and equipment?

3 min read

While some recommendations follow the principles of sound tax policy and may improve the District’s tax climate, some proposals make the tax code more complex and less neutral, potentially disincentivizing investment and business activity.

6 min read

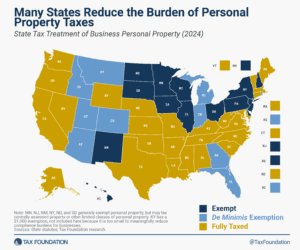

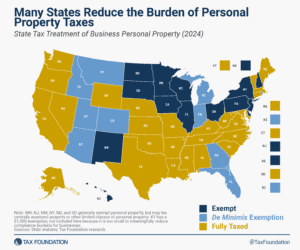

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

3 min read

Legislation currently advancing in Louisiana—related to the franchise tax, inventory tax, and corporate rebate and exemption programs—would make the state’s tax code simpler and more competitive.

4 min read

As housing prices are rapidly increasing, and property tax bills along with them, the property tax has come into the spotlight in many states. The design of a state’s property tax system can affect how attractive that state is to businesses and residents.

9 min read

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read