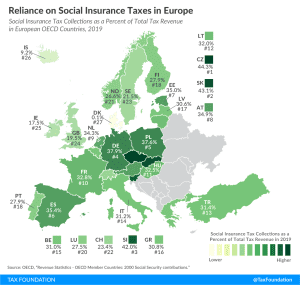

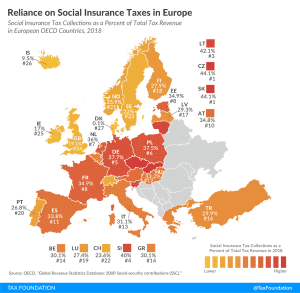

Reliance on Social Insurance Tax Revenue in Europe

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

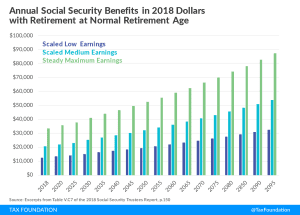

2 min readSocial Security is by far the largest federal government spending program, constituting 21 percent of the federal budget, or $1.3 trillion, in FY 2023—larger than the entire nondefense discretionary budget. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term. By 2035, the Old-Age, Survivors, and Disability Insurance (OASDI) Trust Fund will be depleted, and current payroll taxes will only be able to fund 83 percent of the scheduled Social Security benefits. Absent any reforms, Social Security recipients would immediately face a 17 percent cut in benefits.

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

2 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

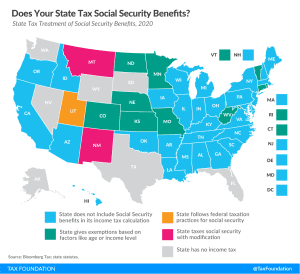

The question, “Does my state tax Social Security benefits?” may be simple enough, but the answer includes a lot of nuance. Many states have unique and specific provisions regarding the taxation of Social Security benefits, which can be broken into a few broad categories.

3 min read

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read

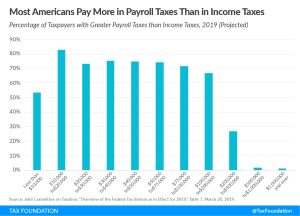

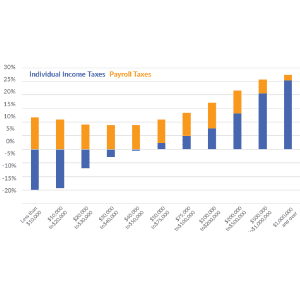

The tax burden for most Americans in 2019 –67.8 percent—will come primarily from payroll taxes, not income taxes. While the income tax is progressive, with average rates rising with income, the payroll tax is regressive, with the highest average rate falling on Americans with the lowest incomes.

4 min read