Proposed Estate Tax Changes in Oregon: A Long-Overdue Reform?

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

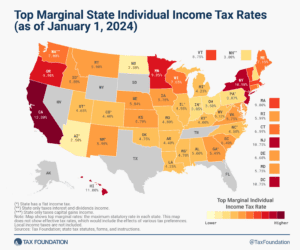

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

The 2024 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

7 min read

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

While some recommendations follow the principles of sound tax policy and may improve the District’s tax climate, some proposals make the tax code more complex and less neutral, potentially disincentivizing investment and business activity.

6 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read